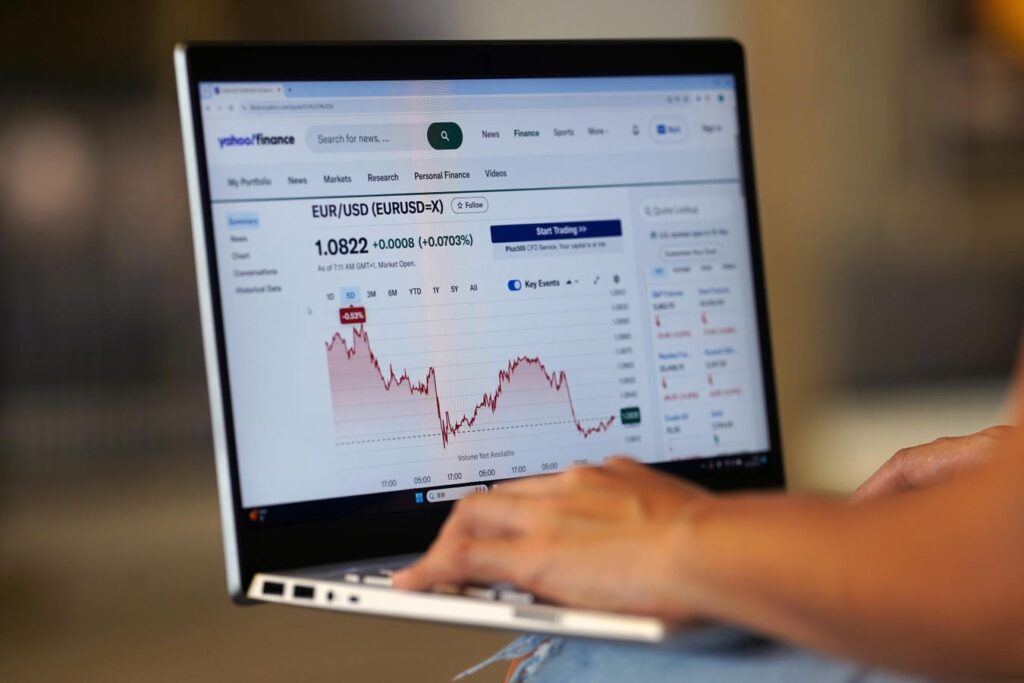

The Euro-USD exchange rate has increased from 1.03 at the beginning of the year to around 1.14 now, with President Trump’s recent tariff threats having stirred global markets. The uncertainty around the tariff war, especially between the U.S. and China, and its potential negative impact on the U.S. economy in the near-to-mid term has made U.S. capital markets extremely volatile over recent weeks. Additionally, talks of a potential rating downgrade for U.S. debt and treasuries have also spooked investors, making them look for “safer” investment avenues and driving the Euro up even as equity markets move wildly in one direction on a day and in another on the very next day. If you find current equity market conditions too volatile for your taste, you could explore our High-Quality portfolio, which aims to limit outsized losses while outperforming the S&P 500 and has achieved returns greater than 91% since inception.

All things considered, the current rally in the Euro/USD is not sustainable and is likely to end with an abrupt crash soon. Why?

Because Exchange Rates Reflect Long-Term Economic Fundamentals

At its core, the Euro/USD exchange rate mirrors the long-term expectations for the relative demand for goods and services between the Eurozone and the United States. When the U.S. economy outpaces Europe in growth, innovation, and resilience, the dollar typically strengthens. Conversely, if Europe leads, the Euro gains. Currently, the Euro’s strength seems disconnected from these underlying fundamentals.

The U.S. Economy Has Better Numbers

A comparison of key economic indicators underscores the disparity between the U.S. and the Eurozone. The U.S. economy witnessed real GDP growth of 2.8% in 2024 vs. 0.9% for the Eurozone. And the current unemployment rate in the U.S. is 4.2% vs. a level of 6.1% in the Eurozone. Inflation levels are also comparable, at 2.4% for the U.S. and 2.2% for the Eurozone.

The Eurozone benefits from a better debt situation, though, as the Debt-to-GDP ratio is below 88% compared to an uncomfortable 124% for the U.S. But then, President Trump’s goals of reducing the country’s trade deficit, encouraging domestic manufacturing, and pressuring other countries to lower their trade barriers via his recent tariff moves primarily aim to address the country’s runaway debt burden. And as long as global investors continue to believe that U.S. debt securities are “risk-free,” the debt-to-GDP figure isn’t really a concern.

And Europe’s Challenges Persist

Moreover, Europe’s structural issues remain unaddressed. The ongoing Russia-Ukraine war and the Israel-Hamas conflict continue to cast a shadow over European stability. Moreover, there has been no significant leap in European innovation or growth-friendly reforms. In contrast, the U.S. continues to demonstrate economic resilience.

Historical Patterns Point To An Imminent Crash

We’ve seen this movie too many times before.

- Back in 2017, the Euro surged – rising from around 1.04 to 1.25 against the dollar. What drove that rally? A mix of optimism over Emmanuel Macron’s pro-EU election, fading fears over Eurozone fragmentation, and improving economic data from Germany and France. Markets believed Europe was back. But by early 2018, the rally stalled, as the European Central Bank (ECB) held off on rate hikes even as the Fed kept tightening. U.S. tax cuts under Trump fueled growth and capital inflows into the dollar, and soon the EUR/USD fell back to around 1.12–1.14 by the end of 2018.

- Then came 2020. Following the initial COVID crash, the Euro once again spiked—this time from around 1.06 to nearly 1.23 in early 2021. Investors were bullish on Europe’s pandemic recovery fund and the region’s ability to coordinate fiscal stimulus while the Federal Reserve slashed interest rates and began a historic QE program, weakening the dollar. But reality bit by mid-2021, when the Fed began signaling tapering while Europe’s recovery sputtered. Supply chain issues lingered. Energy prices spiked. The ECB stayed behind the curve. Once again, capital flowed back to the dollar, and the Euro slid back below 1.10 by early 2022.

These episodes show a clear pattern: initial optimism about Europe’s prospects leads to a Euro rally, but structural disadvantages—slower growth, policy paralysis, and a more reactive central bank—ultimately drag it down. The current rally in the Euro is showing signs of the same disconnect.

This Shock Might Feel Unique, But the Pattern Is Unmistakable

Every economic shock feels unprecedented in the moment. However, the broader context – a larger, stabilizing system – remains consistent. This system enforces a pattern: an initial shock (like Trump’s tariff threats), a period of adjustment, and eventually, a return to fundamentals.

- After the initial shock, markets often enter a phase of denial or over-optimism. Media narratives may downplay underlying issues, and investors might hope for quick resolutions. However, as the dust settles, the reality of economic fundamentals becomes apparent, prompting a reassessment of asset valuations, including currency exchange rates.

- Eventually, policymakers and markets acknowledge that previous strategies aren’t yielding desired outcomes. In this scenario, President Trump may recognize the limitations of tariff-based policies, leading to negotiations and policy shifts.

- As these adjustments occur, the Euro/USD exchange rate is likely to realign with the underlying economic realities – the core fundamentals

The Euro’s Strength Is on Borrowed Time

Sure, the Euro rally could extend for a few more weeks as investors react to every “breaking news” surrounding the tariff war. But even if you don’t believe that history repeats itself, you will have to concede that it does rhyme. And all signs point to a crash in the Euro/USD exchange rate in the not-too-distant future.

While you can look at several ways to make money off potential Euro-USD trades, a long-term investment option you can explore is the Trefis High Quality (HQ) Portfolio, which is rooted in quality that seeks reliability, predictability, and compounding growth. With a collection of 30 stocks, it has a track record of comfortably outperforming the S&P 500 over the last 4-year period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics

Read the full article here