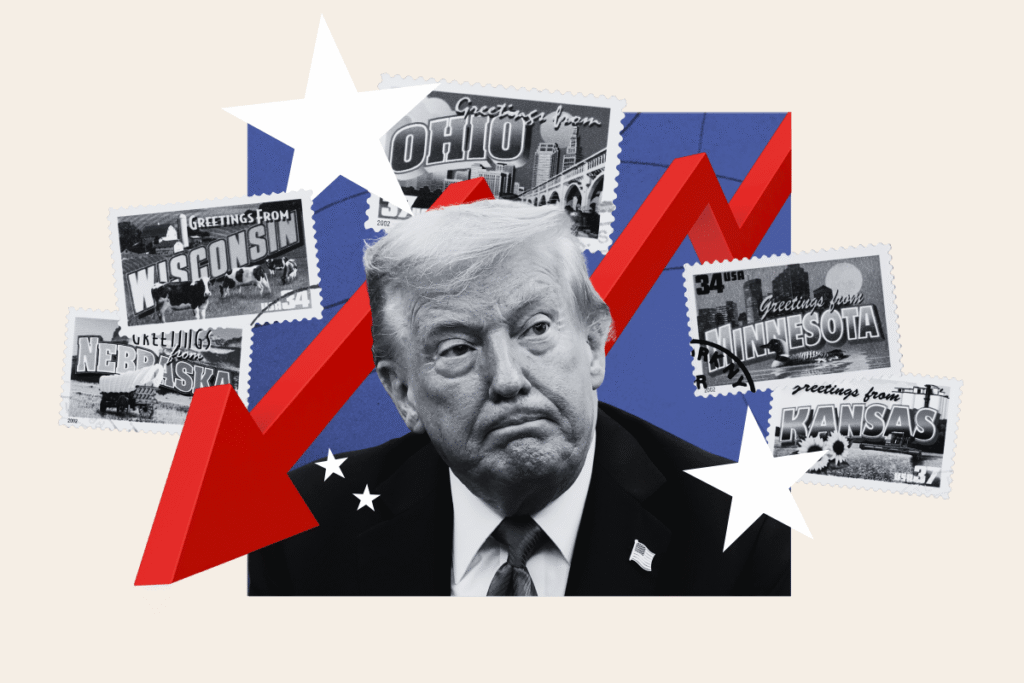

Once the heart of President Donald Trump’s political base, the Midwest — the region he promised to revive with factory jobs and “America First” trade policies — is showing signs of disillusionment.

The latest TIPP Insights poll, conducted between September 30 and October 2, found Trump’s favorability in the Midwest at 40 percent favorable and 49 percent unfavorable, one of his weakest showings nationwide. The decline is striking given that Trump has long positioned himself as a champion of blue-collar workers and has frequently touted his record of reviving the region’s industrial economy.

“I think of the Midwest as quintessentially the most ‘purple’ or swingy region in national politics,” J. Miles Coleman, associate editor of Sabato’s Crystal Ball at the University of Virginia Center for Politics, told Newsweek. “With that, it’s not too surprising to me that Trump’s approval there, -9, is roughly in line with where he is nationally.”

Trump’s highest favorability was recorded in the Northeast (47 percent favorable, 43 percent unfavorable) — an unexpected result for one of the nation’s most liberal regions. He also performed well in the South (46 percent favorable, 43 percent unfavorable), where Republican registration remains strong.

The West was Trump’s least favorable region, with 38 percent viewing him positively and 50 percent negatively.

The Midwest at the Heart of Trump’s 2024 Strategy

The Midwest was central to Trump’s 2024 re-election campaign. He won eight of the 12 Midwestern states, flipping both Michigan and Wisconsin — two states he had narrowly lost in 2020. In Wisconsin, Trump won 49.6 percent of the vote to Kamala Harris’s 48.7 percent, while in Michigan he became the first Republican to carry the state twice since Ronald Reagan.

His choice of Ohio Senator JD Vance as his running mate underscored the region’s political importance. Announcing the pick, Trump said Vance “will be strongly focused on … the American Workers and Farmers in Pennsylvania, Michigan, Wisconsin, Ohio, Minnesota, and far beyond.”

At the time, Anthony Zurcher, the BBC’s North America correspondent, wrote that “the pick suggests Trump knows this election will be won and lost in a handful of industrial Midwest battleground states.”

And ahead of that announcement, Angelia Wilson, a politics professor at the University of Manchester, England, told Newsweek: “Any reasonable political strategy points to Vance and the need to ensure a solid win in Ohio and the Rustbelt.”

Trump’s Midwest Promise

Throughout the 2024 campaign, Trump returned repeatedly to the theme that only he could restore the region’s lost industrial power. In Saginaw, Michigan, he vowed to make the state once again the “car capital of the world,” blasting what he called “energy policies that are stripping jobs” from American workers. “Michigan, more than any other state, has lost 60 percent of your automobile business over the years,” he said.

In Mosinee, Wisconsin, Trump leaned on trade threats as a key policy tool. Speaking at a rally, he warned of “unprecedented tariffs” against foreign competitors and argued that immigrants were displacing U.S. workers — framing his agenda as a defense of the industrial Midwest, Reuters reported.

And in one of his most direct economic moves, Trump threatened 200 percent tariffs on John Deere if the agricultural giant shifted production to Mexico, a signal to Midwestern manufacturers that his “America First” stance still applied to them.

Tariffs, Inflation, and the New Economic Anxiety

But while Trump’s message of protectionism once resonated deeply across the Midwest, cracks are beginning to show. Many farmers and manufacturers are now feeling the pinch of tariffs that have reduced exports and driven down crop prices.

“There have been constant headlines of farmers being caught in the middle of Trump’s tariff fights, so that might be an especially salient issue in the Midwest,” Coleman said.

Trump has dramatically expanded U.S. tariffs since returning to office, marking one of the most sweeping protectionist shifts in decades. In February 2025, he imposed new duties of 25 percent on imports from Canada and Mexico and 10 percent on Chinese imports, citing national security concerns related to drug trafficking and border security, according to a White House fact sheet.

Two months later, Trump issued Executive Order 14257, known as “Liberation Day,” introducing a 10 percent baseline tariff on nearly all imports and authorizing higher duties — in some cases up to 50 percent — on goods from countries accused of unfair trade practices. The order also revoked the de minimis exemption that had allowed low-value imports to enter the U.S. tariff-free, and expanded tariffs under existing laws such as Section 232 and the International Emergency Economic Powers Act. The measures targeted key industries including autos, steel and aluminum.

The administration has defended the tariffs as essential to rebuilding American manufacturing and protecting domestic jobs. But economists have warned of steep costs. The Penn Wharton Budget Model estimated the tariffs could reduce long-run GDP by six percent and lower wages by five percent, costing a typical middle-income household about $22,000 in lifetime income losses. The group also projected that the tariffs could raise between $4.5 and $5.2 trillion in federal revenue over the next decade — gains that could be offset by inflation and supply chain disruptions.

For farmers, tariffs have been a thorn in their side since 2017, when Trump first imposed tariffs on key trading partners.

Since then, American farmers have struggled with the loss of China as the top buyer of U.S. soybeans and a major market for corn. Exports of soybeans — America’s largest grain export by value — recently fell to a 20-year low, deepening fears that China may not purchase any U.S. grain this season.

“With [tariffs] in place, we are not competitive with soybeans from Brazil,” Virginia Houston, director of government affairs at the American Soybean Association, told The Guardian. “No market can match China’s demand for soybeans. Right now, there is a 20 percent retaliatory duty from China.”

Trump has said little publicly about the impact on farmers, though in August he demanded on Truth Social that China quadruple its soybean purchases. Chinese officials have instead pledged to boost domestic production by 38 percent by 2034, and U.S. farm groups say no new Chinese orders have been placed for the upcoming season.

Despite the financial pain, many rural voters continue to back Trump, emphasizing that their support isn’t determined by a single issue like tariffs.

“Tariffs are probably something that will help in the long run,” Ohio farmer Brian Harbage, told The Guardian, acknowledging current export difficulties and economic uncertainty.

To ease the strain, the Trump administration included $60 billion in farm subsidies in its latest tax bill, but critics argue the money favors large producers over family farms. Meanwhile, falling commodity prices, smaller cattle herds, and declining ethanol production have further weakened the sector.

“The farm economy is in a much tougher place than where we were in 2018,” Houston said. “Prices have gone down while inputs – seed, fertilizer, chemicals, land and equipment – continue to go up.”

Harbage said if Trump visited his farm, his message would be simple: “The exports is number one. That’s the number one fix. We have to get rid of what we’re growing, or we have to be able to use it. China, Mexico and Canada – we export $83 billion worth of commodities to them a year. So if they’re not buying, we’re stuck with our crop.”

Renewable Energy Rift

Trump’s opposition to renewable energy subsidies is also creating unease among farmers.

In Iowa, where nearly two-thirds of electricity comes from wind and more than 50 wind-related companies operate, the end of federal incentives under Trump’s “One Big Beautiful Bill” has thrown the industry into turmoil. The cuts have imperiled $22 billion in wind investments and tens of thousands of jobs tied to wind manufacturing and land leases. Wind farms are the top taxpayer in a third of Iowa’s counties, contributing up to 55 percent of local property taxes and $91.4 million in annual lease payments to farmers, according to Power Up Iowa.

Farmers and local officials warn that Trump’s policies threaten this economic lifeline. “I don’t know how anybody in good faith could vote against alternative energy if they’re elected by the people in Iowa,” Fort Madison Mayor Matt Mohrfeld, told Politico, calling the cuts “a crucial mistake.”

Republicans argue that wind and solar are now “mature industries” that no longer need government help. But clean energy developers and local leaders say the rollback is already causing uncertainty, job losses, and halted projects — including the shutdown of Iowa wind manufacturer TPI Composites, which cited “industry-wide pressures” after losing federal support.

Trump Energy Secretary Chris Wright has argued that heavy federal government spending on renewable energy is “nonsensical.”

Read the full article here