A recent report by the personal finance website WalletHub has ranked the best states in the U.S. for retirement.

Why It Matters

WalletHub noted in its study that the choice of retirement location can greatly influence how far savings stretch, with 65 percent of non‑retired adults reporting their retirement savings aren’t on track.

What To Know

WalletHub cited Wyoming’s retiree appeal as driven largely by affordability, with a retiree-adjusted cost of living in the more affordable half of the nation, a retired taxpayer-friendly environment that includes no estate or inheritance tax, and the fifth-lowest annual cost of homemaker services.

Wyoming’s overall quality-of-life factors included the 10th-best elder-abuse protections, the fifth-lowest violent crime rate and the 14th-highest share of residents who do favors for their neighbors. Financially, the state had the seventh-lowest share of residents 65 and over in poverty.

Coming in second, Florida’s ranking reflected relatively low taxes for retired people—including no estate, inheritance or income tax—as well as high levels of Older Americans Act funding per senior that support transportation, homemaker assistance and nutrition programs, the report said.

Florida’s quality-of-life strengths included the second-most shoreline miles, the second-most adult volunteer activities, the fifth-most theater companies, and the eighth-most golf courses and country clubs. The state also had the third-lowest death rate for people ages 65 and older, though WalletHub noted that the overall cost of living was relatively high compared with many states.

Ranking third, South Dakota offered taxpayer-friendly conditions with no estate or inheritance taxes, the 13th-lowest poverty rate for residents 65 and over and the fourth-lowest percentage of seniors who faced hunger in the previous 12 months, WalletHub found.

The state’s health-related advantages included one of the lowest rates of senior social isolation, the second-best geriatrics hospitals, the second-lowest share of seniors with frequent mental distress and the third-most family medicine physicians per capita, alongside environmental strengths such as the fifth-best air quality and the third-lowest rate of health-based drinking-water violations.

How It Was Calculated

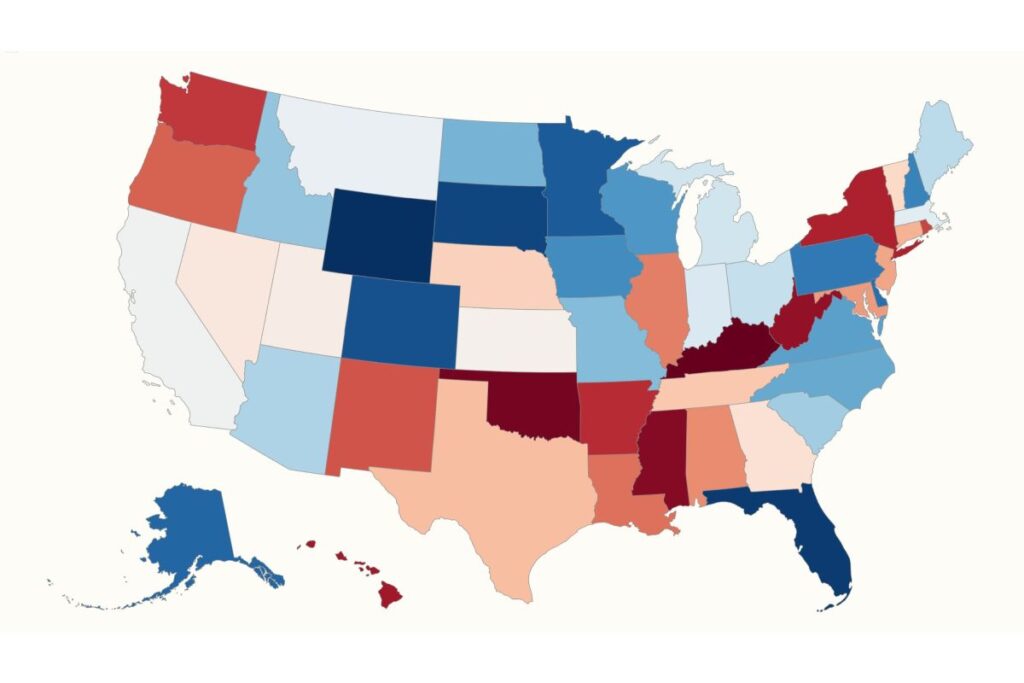

WalletHub ranked the 50 states for retiree‑friendliness by scoring them across three pillars—affordability, quality of life and health care—built from 46 metrics. Each metric was graded on a 100‑point scale. WalletHub then calculated a weighted average across all metrics to produce each state’s overall score and ranking.

What People Are Saying

WalletHub analyst Chip Lupo said in the report: “Retirement is supposed to be relaxing, but it can also be incredibly stressful given that it typically puts people on a fixed income, which may not be enough for them to live comfortably. As a result, the best states for retirees are those that have low taxes and a low cost of living to help retirees’ budgets stretch as far as possible. Having access to excellent medical care and homemaking services is also crucial, especially for people who don’t plan to retire in close proximity to their families.”

What Happens Next

WalletHub releases its “Best and Worst States to Retire” report annually.

In a polarized era, the center is dismissed as bland. At Newsweek, ours is different: The Courageous Center—it’s not “both sides,” it’s sharp, challenging and alive with ideas. We follow facts, not factions. If that sounds like the kind of journalism you want to see thrive, we need you.

When you become a Newsweek Member, you support a mission to keep the center strong and vibrant. Members enjoy: Ad-free browsing, exclusive content and editor conversations. Help keep the center courageous. Join today.

Read the full article here