Artificial Intelligence (AI) has clearly been the dominant investment theme of 2024 and is the next major technology wave. According to IDC, spending on AI will be in excess of $631 billion by 2028. With ever increasing interest and spending in AI, there are also a rising number of ways to participate in this massive theme. ETF baskets are a great way to gain exposure. Just this week, the world’s largest asset manager, Blackrock, launched two new ETFs, the iShares A.I. Innovation and Tech Active ETF (BAI) and the iShares Technology Opportunities Active ETF (TEK). There are likely many more on the way. However, not all are created equal.

Some of the beneficiaries of AI may not be immediately obvious. These include Data Center REITs like Digital Realty Trust (DLR) and Equinix (EQIX) as well as companies that are involved with the construction the infrastructure for data centers as represented in the ETF PAVE. Also, the need to generate increased electrical production in the U.S. has had a positive effect on Utilities. In addition, nuclear power is making a comeback in the U.S. Hence, uranium stocks are performing better as one can see in the performance of URA.

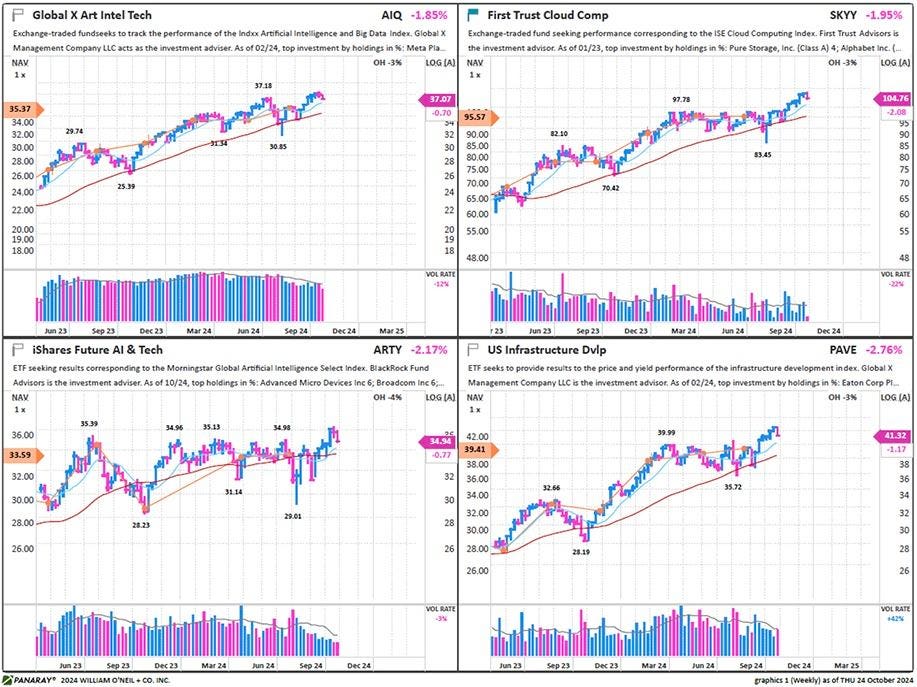

Stronger Performing AI Beneficiary ETFs:

Figure 1: Weekly Charts of Leading AI-Related ETFs

Weaker Performing AI Beneficiary ETFs:

- iShares Semiconductors (SOXX), Global X Robotics and AI (BOTZ), Invesco AI and Next Generation Software (IGPT), and iShares Exponential Tech (XT) also have some exposure to the AI theme. Some are related to other themes in the market for which demand has varied recently, like the demand for smartphones and automobiles. These more tangential plays are shown below in Figure 2.

Figure 2: Weekly Charts of Lagging AI-Related ETFs

Broad Market ETFs:

- Invesco Nasdaq 100 (QQQ), and Vanguard Mega Cap Growth (MGK): These two are not exclusively AI plays but have a huge weight in the big spenders, such as Microsoft (MSFT), Meta (META), Amazon (AMZN), and Google (GOOGL) driving the theme forward.

Figure 3: Weekly Charts of the Above Two ETFs

There are many use cases for AI, most relating to costs savings and efficiency/productivity gains across nearly every sector. Some of the larger being search assistance, automated machine learning, data-driven marketing, fraud/network intrusion detection, financial robo-advisory, supply chain optimization, factory automation, self-driving technology, drug discovery, and more recently generative AI, among others. There will be many opportunities in those companies that can harness the technologies. But we would like to now take a closer look at some of the beneficiaries of all of the spending happening to create the necessary infrastructure, in particular the powering of all of the growing use cases: data centers.

In terms of data centers, according to industry estimates, the market size could rise from around $200B in 2022 to nearly $450B by 2028.

McKinsey notes that electricity demand from data centers is expected to rise by over 150% by 2030. It usage will rise from under 2% compared to total installed capacity to >4% over the period. While it is a small portion, it is still a huge amount of new power needed. Hyperscalers like Alphabet, Meta, Amazon (AMZN), Microsoft, and Oracle (ORCL) account for around 40% of the data center capacity. Non-hyperscalers (colocation) account for ~25% and on premise for the remainder.

Figure 4: Growth in Data Center Electricity Demand

As we mentioned in our May Forbes article, “Power Up Your Portfolio With Utilities,” United States overall electricity demand should rise +1 to 3% a year for the next decade.

Current estimates could continue to rise. Other more aggressive estimates put the percentage of electricity consumption from data centers in the high-single digits by 2030. Recent power supply deals from Microsoft and Alphabet underscore the coming growth, as well as the continued need to shift towards clean energy sources.

- In September, MSFT and the U.S.’ leading nuclear power provider Constellation Energy (CEG) reached a significant power supply agreement. CEG will restart the 835MW nuclear facility on three-mile island that was formerly retired in 2019. MSFT will then purchase energy from the plant from its restart date ~2028 for a period of 20 years. It will help ease some of the increasing strain on the PJM grid, which covers 13 mid-Atlantic states.

- In October, GOOGL announced a deal with nuclear startup Kairos to build seven small nuclear reactors with combined capacity of 500MW, expected to come online near the end of the decade. While hurdles still exist, to date there are no commissioned small-modular nuclear reactors, the industry appears to be moving forward aggressively.

Although the Nasdaq 100 and Mega Cap growth groups were huge outperformers over about an 18-month period from the beginning of 2023, they have trailed off in relative terms recently. There has been a shift in leadership from the spenders (hyperscalers) as the leaders to the infrastructure product and services, and energy providers, particularly related to data centers.

Below are 25 O’Neil Industry Groups related in some way to data centers, detailed with some price performance and other metrics. Nearly all have been winners over the trailing 52 weeks, however, over eight to 13 weeks, there is a large separation between the top few and the rest.

Figure 5: List of O’Neil Industry Groups Related to Data Centers

In Conclusion

The AI revolution offers many exciting investment opportunities beyond simply semiconductors and software. In particular, companies that construct, operate, and power data centers are likely to be strong beneficiaries of this massive trend. We encourage investors to explore these areas in greater detail as we believe many of these stocks will be market leaders over the next decade.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., made significant contributions to the data compilation, analysis, and writing for this article.

Disclaimer

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. William O’Neil + Co., its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

William O’Neil + Co. Incorporated is an SEC Registered Investment Adviser. Employees of William O’Neil + Company and its affiliates may now or in the future have positions in securities mentioned in this communication. Our content should not be relied upon as the sole factor in determining whether to buy, sell, or hold a stock. For important information about reports, our business, and legal notices please go to www.williamoneil.com/legal.

© 2024, William O’Neil + Company, Inc. All Rights Reserved.

No part of this material may be copied or duplicated in any form by any means or redistributed without the prior written consent of William O’Neil + Co.

Read the full article here