Slowing growth and a reliance on intangible value threaten upside potential

By Oliver Rodzianko

Summary

- Apple’s revenue growth is projected to slow from a 10‐year average of 13.4% to roughly 6.4% over 3–5 years, following P/S rising from 4.88 to 8.88 and greater reliance on intangible brand value.

- Despite Q1 2025 revenue reaching $124.3B and an active device base of 2.35B, modest adoption of iPhone 16 AI features and the premium pricing of Vision Pro limit growth amid global competition.

- Valuation metrics near 15‐year highs and price forecasts of ~$448 (bull) to ~$392 (bear) in five years indicate restricted upside, warranting caution for value investors.

Apple Inc. has been one of the most revolutionary technology companies globally; however, moderating growth and an increasing reliance on intangible value have rendered the company more vulnerable from an investment perspective. Even in a bullish scenario, a five‐year compound annual growth rate (‘CAGR’) in price exceeding 15% appears highly unlikely, with returns more realistically expected to fall within the range of 10% to 15%. Consequently, capital may be more judiciously allocated to other opportunities. Although many consumers still consider Apple products irreplaceable, saturated markets, increased international competition, and weakening innovation suggest that Apple stock is not at an ideal entry point for value investors at this time.

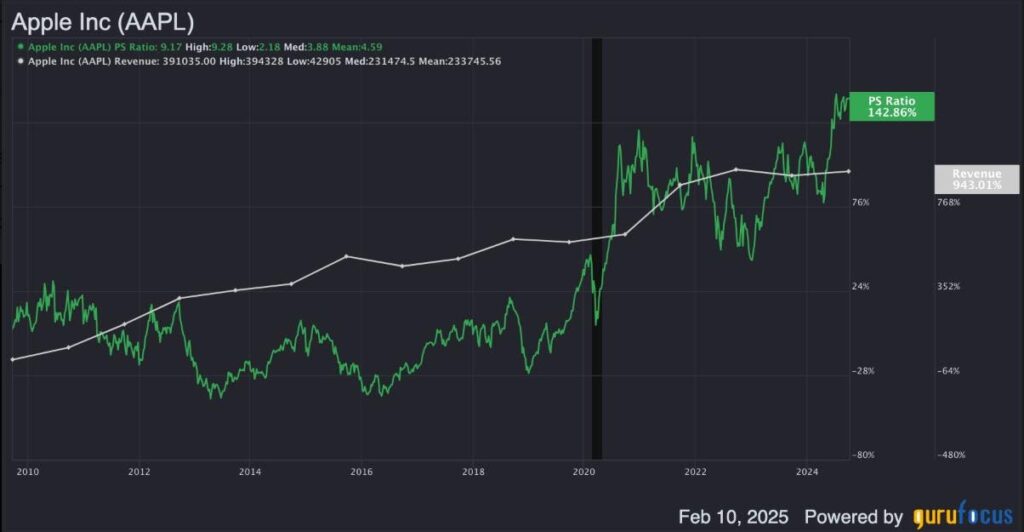

Operations and financials

The primary concern facing Apple shareholders is the deceleration in revenue growth. While Apple’s 10‐year revenue growth rate stands at 13.4%, the consensus estimate for annual revenue growth over the next three to five years is approximately 6.43%. This slower growth is accompanied by an increase in the company’s price-to-sales ratio from a 10-year median of 4.88 to 8.88 at present. Such a shift suggests that the investment thesis for Apple is increasingly reliant on intangible brand value. If the market does not adjust the valuation to a more equitable level, it implies that investors are comfortable holding Apple shares at a premium simply due to brand strength. In light of numerous investments offering higher growth potential at more attractive valuations, Apple’s shares presently harbor an inherent risk of decline.

This revenue growth weakness coincides with the launch of the iPhone 16, which was expected to generate a sustained bull run through the introduction of new Apple Intelligence AI features. However, these AI capabilities were not available at launch and were instead rolled out gradually via software updates, thereby tempering consumer enthusiasm. Moreover, the features have not proven as revolutionary as anticipated, reducing their impact on the user experience.

In addition, the recent introduction of the Apple Vision Pro, although technologically impressive, targets a limited market segment and is not expected to contribute significantly to long-term revenue growth. Priced at $3,499, the Vision Pro is out of reach for many consumers who are more likely to opt for Meta’s Quest 3, which starts at $399. As of December 2024, Apple had shipped approximately 500,000 Vision Pro units, generating total revenue of $1.75 billion from the product. By contrast, iPhone sales in Q1 2025 generated $69.1 billion in revenue—accounting for 56% of Apple’s total quarterly revenue—even though iPhone sales declined slightly from $69.7 billion in Q1 2024. Notably, competition in China—where local smartphone manufacturers are gaining market share—further intensifies these challenges. Nonetheless, robust growth in Mac, iPad, and Services revenues helped partially offset the decline in iPhone sales.

Apple’s operational performance is not entirely negative. The company achieved an all-time high revenue of $124.3 billion in Q1 2025, with earnings per share increasing by 10% year-over-year. In addition, the installed base of active devices reached a record high of over 2.35 billion across all product lines and geographic segments. Although Apple has taken a relatively passive stance regarding AI infrastructure development, this strategy has enabled it to generate strong free cash flow—albeit at the expense of potentially building a significant competitive moat. Instead, Apple has opted to pursue strategic partnerships for AI development without incurring substantial capital expenditures.

Valuation

Apple’s current valuation multiples are nearly at the highest levels observed over the past 15 years, raising concerns given the expected moderation in future growth rates. The company has evolved into a “brand stock”—a market-leading enterprise valued significantly by its intangible assets, much like Tesla. The key difference is that Tesla has a robust growth outlook in areas such as autonomous taxis and humanoid robotics, whereas Apple remains largely dependent on the iPhone—a product now facing market saturation.

The PEG ratio, in particular, exceeds 2, indicating a high valuation relative to earnings growth. This multiple is near the peak observed over the past 15 years when excluding an anomalous period following the COVID-19 outbreak.

While the fundamentals remain crucial, the technical profile of Apple’s stock and the substantial goodwill attributed to its brand may provide medium- to long-term return resilience. The stock currently exhibits an uptrend, as evidenced by the 50-day moving average crossing above the 200-day moving average. Additionally, the Relative Strength Index (‘RSI’) reading of 65 suggests that the stock is not overbought despite showing bullish tendencies. There may be additional upside potential before a pullback occurs; however, for value investors, the current entry point is suboptimal given the inflated valuation multiples, the underwhelming impact of Apple Intelligence, and the moderate fundamental growth outlook. Apple has effectively become a long-term speculative “goodwill” holding—a stance that may suit sentiment-driven investors but is less appealing to those who demand fundamental justification for valuation.

Using a conservative approach that still acknowledges prevailing market sentiment, one can apply the five-year price-to-free-cash-flow trendline growth rate of 5.76% to forecast a future price-to-free-cash-flow ratio of approximately 40 in five years. With projected revenue of roughly $560 billion and a free cash flow margin of 25%, the estimated free cash flow would be $140 billion. With 12.5 billion diluted shares outstanding (after continued share buybacks), free cash flow per share would be approximately $11.20. At a price-to-free-cash-flow ratio of 40, the projected stock price would be $448. With the current stock price at $228, this projection implies a five-year CAGR of roughly 14.5%.

Bear case

Although the bull-case model suggests a potential price CAGR of 14.5%, such a return is modest and indicates limited upside, even if market sentiment remains robust—a scenario that appears increasingly unlikely. As Apple’s year-over-year growth moderates further, it is conceivable that value and fundamental investors will gradually withdraw capital. Simultaneously, technical investors may begin to detect weaknesses in the stock’s price action, prompting additional sell-offs. These dynamics could result in a significant re-rating of Apple’s valuation over the next five to 10 years. Under a bear-case scenario, using a price-to-free-cash-flow ratio of 35 would yield a projected stock price of $392 in five years, corresponding to an implied CAGR of 11.45% from the current price of $228.

Conclusion

In summary, my analysis indicates that while Apple Inc. may outperform the S&P 500 (SPY) over the next few years, its returns are likely to converge with—or potentially underperform—the broader market over time. Apple is not positioned as an AI or robotics company, sectors that are expected to drive substantial future growth in technology. Given its inflated valuation and moderate growth outlook—driven by market saturation, innovation challenges, and heightened competition—capital may be more efficiently deployed in other opportunities.

Read the full article here