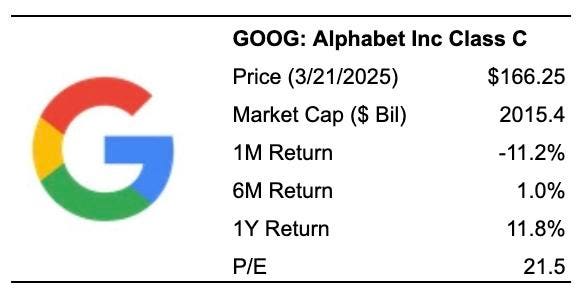

We believe Alphabet could be poised to more than triple its valuation from an already impressive $2 trillion, potentially becoming the world’s most valuable company by a significant margin. Despite a recent 10% decline following mixed Q4 results and higher projected capital expenditures, the real growth opportunity may lie in an often-overlooked asset — the Waymo robotaxi service. Once a speculative initiative, Waymo is quickly transforming into a viable business that could revolutionize transportation and unlock significant value for Alphabet. If it scales effectively, Alphabet’s stock could surpass $500. Here’s why.

Fact: Waymo has increased its weekly paid rides from 10,000 two years ago to around 150,000 by the end of 2024. Currently, Google reports that Waymo is providing over 200,000 paid trips per week across San Francisco, Los Angeles, and Phoenix.

Now, consider the broader ride-hailing market. Uber facilitated more than 230 million rides per week in Q4 alone — which adds up to approximately 12.5 billion rides annually. At an average fare of $30, that translates into an annual revenue pool of about $375 billion.

Given Waymo’s current volume of over 200,000 autonomous rides per week, how many additional people might opt for self-driving rides instead of driving themselves? The potential shift is significant. For every person using a ride-hailing service today, at least 10 others still drive their own vehicles. Many of them might reconsider once they observe millions enjoying a stress-free ride while watching Netflix, compared to being stuck behind the wheel.

Early indicators support this trend. According to Earnest Analytics, Waymo retains users at a higher rate than Uber or Lyft. This suggests that once riders try a fully autonomous experience, they prefer it. Safety is another major benefit. Waymo’s safety report last year indicated a 78% reduction in injury-causing accidents compared to human drivers.

Investors will soon realize that the $375 billion current ride-hailing market could grow significantly — possibly more than threefold. A $1 trillion+ autonomous ride-hailing market isn’t out of reach.

But Aren’t Many Auto And Tech Companies Already Competing In The Autonomous Driving Space?

Yes, but not all are making the same level of progress.

Waymo has an early advantage. One of its top competitors, GM-backed Cruise, lost its driverless permits in California following a serious incident, making Waymo the only publicly accessible robotaxi service in San Francisco. Uber exited its self-driving program over six years ago and now partners with Waymo to integrate autonomous rides into the Uber app in certain cities. They recently began offering robotaxi rides in Austin, Texas, just ahead of the SXSW festival. Meanwhile, Tesla — often seen as an autonomous driving leader — has not yet entered the ride-hailing space. Though it revealed a Robotaxi concept last year, the vehicle is not yet in production. Furthermore, Elon Musk’s growing involvement in politics may alienate some potential customers.

Waymo also leads in technology. Its fleet features a robust mix of high-resolution cameras, LiDAR, and radar systems, enabling a comprehensive view of its surroundings. And let’s not forget Google’s secret weapon — its vast user base, which helps crowdsource annotated data like CAPTCHA codes to train its AI models. This offers a major advantage in understanding complex driving conditions.

The best part?

These are self-driving vehicles — no human drivers, no unions, no employment-related complications, and no labor costs. Although software development and battery costs remain, eliminating driver wages could result in very high profit margins. Margins of 50% are not unrealistic, considering how much driver pay eats into traditional ride-hailing revenues.

If Waymo captures roughly one-third of a $1 trillion autonomous ride-hailing market, it could generate about $300 billion in annual revenue. With 50% margins, that equates to $150 billion in profit. At a 30x earnings multiple, this could translate into an additional $4.5 trillion valuation for Alphabet. Given Alphabet’s current valuation of around $2.1 trillion, this could boost the company’s total market cap to over $6.5 trillion, or more than $500 per share. Admittedly, reaching this scale will take time — unlike signing up for services like Google or Netflix. Investors need to take a long-term view. Think 2030, or even 2035. The key takeaway is that Alphabet is scaling Waymo rapidly, has the technology and strategic advantage, and is addressing a massive potential market, making this lofty valuation possible.

GOOG stock performance over the past four years has been notably inconsistent, with annual returns showing more volatility than the S&P 500. Returns were 65% in 2021, -39% in 2022, 59% in 2023, and 35% in 2024. The Trefis High Quality Portfolio, which includes 30 stocks, has shown significantly less volatility. Over the past four years, it has outperformed the S&P 500 comfortably.

Why is that? As a group, the HQ Portfolio stocks have provided better returns with lower risk compared to the benchmark index — less of a roller-coaster ride, as shown in the HQ Portfolio performance metrics. Considering today’s uncertain macroeconomic environment — rate cut expectations, ongoing conflicts — could GOOG experience a similar underperformance as in 2022 over the next 12 months, or will it see another surge?

Investors may be underestimating not just Waymo’s promise but also Alphabet’s overall Internet business, which continues to perform well. In Q4 2024, Google’s cloud segment revenue jumped 30% to $11.96 billion. Google search revenue rose 12.5% to $54 billion, and YouTube ad revenue climbed 13.8% to $10.5 billion. Overall, Google’s revenues for the quarter reached $96.5 billion, up 12% year-over-year. In addition to revenue growth, Alphabet’s operating margin expanded by 500 basis points year-over-year to 32% in Q4. The combination of increased revenue and margin expansion led to a 31% increase in earnings per share to $2.15. The stock remains attractively valued, trading at just 19x consensus 2025 earnings and 17x consensus 2026 earnings.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here