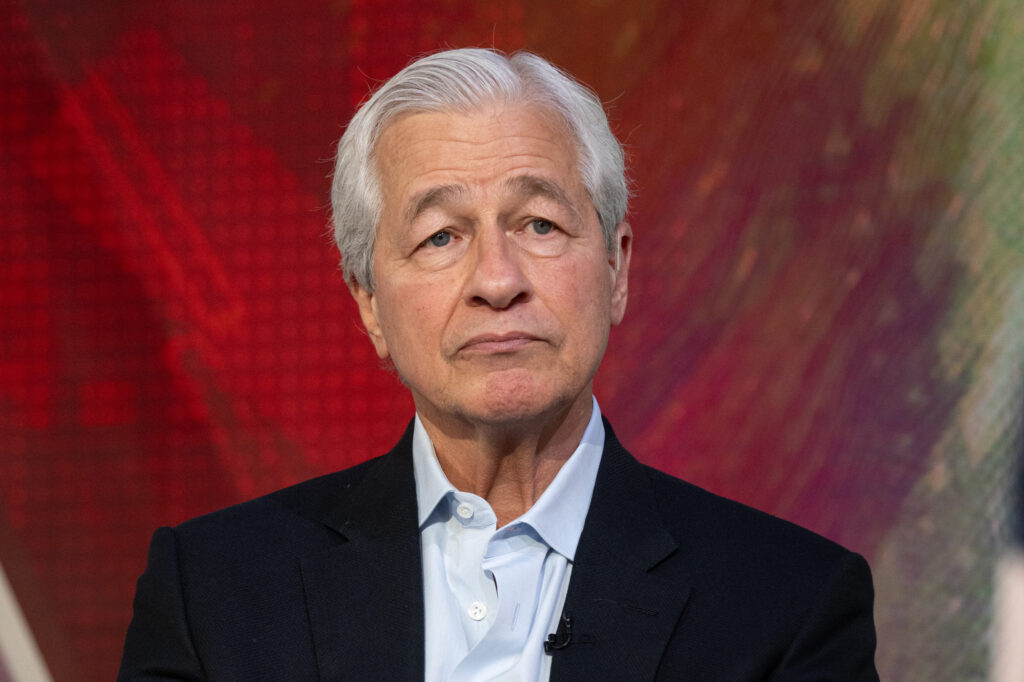

JPMorgan Chase CEO Jamie Dimon has warned that inflation risks remain elevated despite the temporary reduction in tariffs announced by the U.S. and China last week, and that markets have exhibited an “extraordinary amount of complacency” regarding the long-term impacts of the trade dispute.

Speaking at the financial institution’s investor day on Monday, Dimon said: “I don’t think we can predict the outcome and I think the chance of inflation going up and stagflation is a little higher than other people think,” he added.

Why It Matters

While inflation has eased, according to recent official data, consumer surveys reveal lingering anxieties about the prospect of rising prices through 2025—anxieties that, as Dimon noted, the tariff pause has not yet dispelled.

Experts told Newsweek previously that despite the 90-day pause—intended as a window for more comprehensive negotiations between the U.S. and China—the reduced rates still remain high compared to previous levels, and there still exists a strong possibility of the trade war reigniting.

What To Know

JPMorgan was among the institutions to lower its forecasts of a recession in 2025 following the announcement of a significant but temporary reduction in the tariffs between the U.S. and China on May 12. The firm lowered the probability to 50 percent from 60 percent previously.

Stock markets rallied following the announcement that tariff rates on Chinese imports would be reduced to 30 percent from 145 percent, and that China’s rates on American goods would drop to 10 percent from 125. America’s benchmark indexes—The S&P 500, Dow Jones Industrial Average and Nasdaq Composite—are now all trading above their levels before Donald Trump’s “Liberation Day” speech on April 2.

However, Dimon said that much of this investor optimism stemmed from the fact that the effects of the remaining tariffs had not yet materialized. “People feel pretty good because you haven’t seen an effect of tariffs,” he said on Monday. “The market came down 10 percent, it’s back up 10 percent—I think that’s an extraordinary amount of complacency.”

What Is Stagflation?

In addition to inflation, Dimon warned that the risks of “stagflation” were more elevated than many believed. The term denotes stagnant economic growth, alongside high unemployment and persistent inflation.

The three do not typically increase simultaneously, and this creates a significant challenge for central banks given the given the inverse effects of the remedies used to address each issue. Raising or maintaining interest rates at high levels is normally used to combat inflation, but doing so can limit economic growth. Stimulating economic growth and employment by lowering borrowing costs, meanwhile, can contribute to inflation.

What People Are Saying

Michael Feroli, chief U.S. economist at JPMorgan, wrote on Monday: “The administration’s recent dialing down of some of the more draconian tariffs placed on China should reduce the risk that the U.S. economy slips into recession this year. We believe recession risks are still elevated but are now below 50 percent.”

Federal Reserve Chair Jerome Powell, during a press conference before the U.S-China-tariff pause, said: “If the large increases in tariffs that have been announced are sustained, they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment. The effects on inflation could be short-lived—reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent. Avoiding that outcome will depend on the size of the tariff effects, on how long it takes for them to pass through fully into prices, and, ultimately, on keeping longer-term inflation expectations well anchored.”

Treasury Secretary Scott Bessent, in an interview with CNN on Sunday, said that tariff rates could return to the “reciprocal” levels announced by the president on April 2 if countries “do not negotiate in good faith.” Bessent added that there were 18 “important” trading partners the U.S. was focused on striking deals with.

What Happens Next?

The temporary reduction in tariffs between the U.S. and China is due to last until mid-August, while the 90-day pause on other nations’ “reciprocal” tariffs, announced by Trump on April 9, will extend into July.

Read the full article here