New data released by the personal finance company WalletHub has shown the states with the highest and lowest credit card debt increases between the first and second quarters of this year.

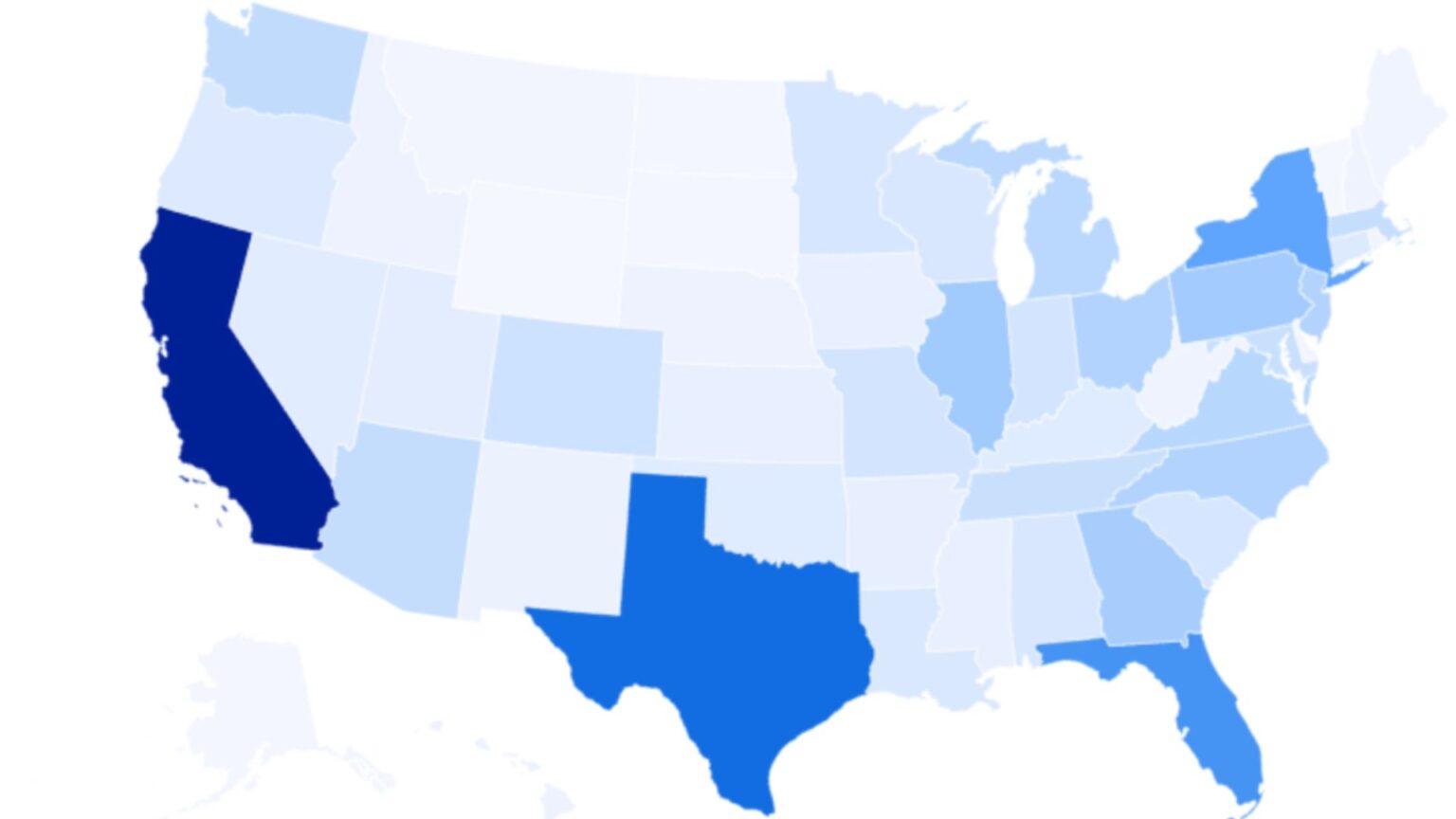

California, Texas, New York, and Florida topped the list, WalletHub said.

Across the country, credit card debt is high—the collective debt stands at around $1.32 trillion, with around $65 billion of that amount coming from last year alone, WalletHub reported.

Why It Matters

The high level of credit card debt in the country reflects a number of challenges facing consumers at present.

Since President Donald Trump took office in January, already high grocery prices have been rising even further, and top economists have warned that there are already warning signs showing up in the housing and employment markets, as well as consumer prices, which indicate a major economic downturn isn’t too far away.

What To Know

Lisa Servon, a professor in the Department of City and Regional Planning at the University of Pennsylvania, told Newsweek that in the four states with the highest credit card debt housing costs were probably a factor.

While this in part reflects these states’ higher population, it also “seems likely that higher housing costs, especially in California, New York, and Florida, play an important role,” she said.

“I’d hypothesize that the disparity between income and expenses in these states is a key factor driving credit card debt increases,” she said.

California, Texas, New York and Florida are seeing sharper increases in credit card debt because “residents already carry higher-than-average household balances, face high costs of living, and many live in dense urban centers where spending tends to be higher, all of which amplify overall debt growth,” WalletHub’s writer and analyst, Chip Lupo, told Newsweek.

Other Eastern states had slightly higher credit card debt increases, while the Mid West and south (except for Texas), had lower increases.

“Recent data shows that states in the Midwest and the south currently have lower credit card debt, and this is likely a result of lower cost of living, making it less common for folks to need to cover regular expenses with credit cards,” Servon said.

States like Wyoming, Vermont, North Dakota, and South Dakota tend to have lower rates of credit card debt increase, Lupo said.

This is not “just because of smaller populations, but also because households there carry lower average balances and overall debt levels, which limit how much those totals can increase every quarter,” he added.

Nationally, credit card debt in the U.S. is high—although WalletHub found that the increase during the second quarter of 2025 was around 21 percent smaller than the increase in the second quarter of 2024.

Total credit card debt as of the second quarter of this year was roughly $1.32 trillion on an inflation-adjusted basis—about 13 percent below the record high.

Meanwhile, the average household credit card balance was around $10,951 at the end of the second quarter of 2025, after adjusting for inflation—about $2,062 below the record high.

A number of factors are driving the current high level of credit card debt. “Consumers are managing high interest rates, stagnant wages, and persistent inflation which—even though it has slowed—has had an effect on prices,” Servon said. “People are likely using credit cards to keep up with everyday expenses.”

Also, credit card annual percentage rates have also gone up, she said, “making debt more expensive for folks who do not pay off their credit card debt every month.”

“With the cost of credit card debt rising, more of credit card holders’ payments is going to interest rather than the principal,” she added.

Servon said that rising prices and the higher cost of credit is also “coupled with stagnant wages.”

“This combination of factors often results in people using credit cards to fill the gap, particularly when they’re hit with emergencies of other unexpected expenses,” she said, adding that consumers may have dipped into their savings during the pandemic, reducing that buffer, pointing them toward credit cards.

“The combined effect has resulted in more delinquencies, which is a clear sign of financial distress,” she said.

To gather the data, WalletHub analyzed credit card debt increase in each state from the first quarter and second quarter of this year using information on TransUnion, as well as the Federal Reserve, adjusted for inflation.

What People Are Saying

Lupo told Newsweek: “Credit card debt is so high nationally, currently at about $1.32 trillion, because Americans are continually adding to their balances, tacking on around $65 billion of new debt just in the past year. This illustrates how widespread consumers’ reliance on credit cards has become across all 50 states.”

He added: “This year does stand out as being particularly high. This suggests that in an economy in which wages are typically not keeping up with the rate of inflation, American households are leaning more heavily on credit cards just to cover everyday expenses.”

What Happens Next

With various warning signs already showing up in the U.S. economy, it is likely that financial stress will continue to ramp up for Americans, and lead to further increases in credit card debt.

Read the full article here