Skeptics stand corrected, but regulators must allow market forces free reign for IPOs to thrive

Hong Kong-listed equities have been on a wild ride in recent weeks.

A series of pro-growth stimulus announcements from Beijing sent trading volumes and share prices soaring by 30% before giving back some of the gains. The Hang Seng Index in Hong Kong jumped 3 percent.

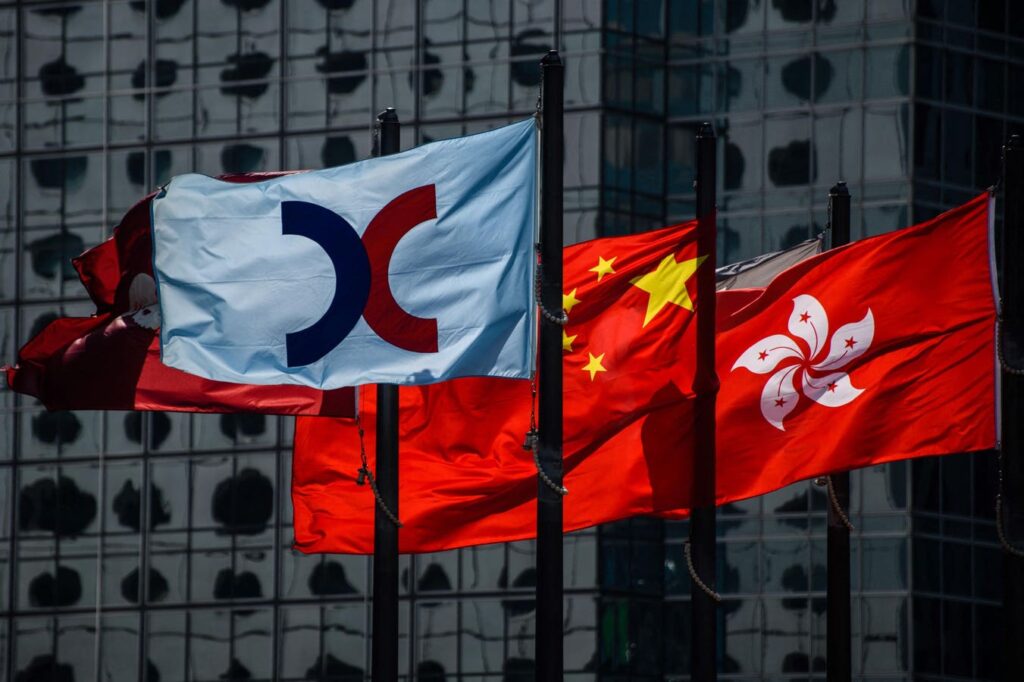

In recent weeks, we have seen China-based Midea Group’s $4.6 billion offering vault the Hong Kong Stock Exchange back into the top five position after an anemic first half of IPOs.

As China’s government admits to “economic difficulties”, Hong Kong naysayers may need to reconsider their position.

With a solid pipeline of new listing applications, the exchange has a solid shot at the top three spots behind the NYSE and NASDAQ by year-end.

While political sensitivities have curtailed Chinese unicorn’s choices, Hong Kong is the best option to access the capital markets and earn tradeable currency. This is especially important for growth and opportunities to make acquisitions in emerging markets like Singapore, Africa, India and Indonesia.

China Simply Too Important To Ignore

Earlier this summer, market commentators like Stephen Roach had written off Hong Kong’s future, claiming that slowing growth rates on the Mainland and restrictions on the free flow of information would doom Hong Kong to be just another sizable Chinese city rather than a center of financial gravity in Asia.

However, rumors of Hong Kong’s demise have been greatly exaggerated. Persistent geopolitical tensions have underscored the city’s unique position as a portal between China and the West.

As mainland China struggled with the fallout from a declining real estate market and anemic consumer confidence, it was fashionable to claim that China had become permanently “underweight” in global portfolios or was even “uninvestable.”

The notion that investors would wholly abandon the world’s second-largest economy is risible. Even if China is moving toward an era of more moderate growth, gloomy sentiment made many equities simply too cheap to ignore. And corporate leadership demonstrated their conviction that their stocks were undervalued by engaging in record levels of stock buybacks in 2024.

The violence of stock prices’ “melt-up ” in recent weeks has demonstrated how fast a bearish consensus can transform into full-blown FOMO. The China long trade has been the most profitable maneuver for global hedge funds, while funds with short positions have experienced a painful unwinding process.

Beyond near-term trading opportunities, global investors cannot afford to ignore China, which is now setting the pace in large slices of the global economy, including automotive, renewables, e-commerce, and electronics. The fate of a fund manager’s core holdings of U.S. and European equities is just as likely to be determined by emerging competitors in Shenzhen, Beijing, or Changsha as by its domestic rivals.

Hong Kong Is An Irreplaceable Asset For The PRC

Similarly, Hong Kong will continue to play an irreplaceable role as China’s near-shore financial center.

Two decades ago, many of China’s most innovative companies followed a well-trod path of attracting multiple rounds of venture investment followed by a listing on the NYSE or NASDAQ. This enabled high-growth companies to access public capital markets years before meeting the profit thresholds required for a domestic IPO and made fortunes for early investors in companies like Alibaba and JD.com.

More recently, it seemed as if the Shanghai Star Market would eclipse both Hong Kong and the U.S. as the listing venue of choice for Chinese tech companies. However, in 2024, the Star Market dropped to 20th place in the global rankings from the top spot last year, as China imposed strict new qualitative standards and underwriter liability that led to hundreds of PRC companies withdrawing their IPO applications. Regulators on the mainland continue to view restricting the supply of new issues as an effective strategy for propping up investor confidence.

At the same time, the path to a U.S. listing has become increasingly tortuous for high-profile Chinese companies. Under the new CSRC review process implemented in 2023, issuers must obtain clearance that an overseas listing would not pose any risks to “security sensitive” information due to foreign disclosure requirements. As illustrated by the recent debacle with the Shein IPO plan, U.S. politicians are quick to summon up imagined threats to American consumers for any company with significant operations in the PRC.

According to Renaissance Capital, China continues to generate a sizable number of U.S. IPOs, accounting for 30 of the 109 new listings this year. However, with only a handful of exceptions, these have been smaller enterprises that can fly beneath the radar of both Chinese regulators and American politicians. While a US listing continues to offer unmatched corporate branding on the world stage, some management teams may decide it poses too high exposure to shifting political winds.

A Hong Kong listing may provide just the right balance for many companies. It enables them to tap into a broad range of institutional shareholders while remaining within an established yet China-friendly regulatory regime. They can raise proceeds in fully convertible currency to facilitate their overseas growth strategies, including making investments and acquisitions in Southeast Asia, Latin America, and Africa. Listing in Hong Kong insulates their public status from the vagaries of U.S.-China geopolitics to some degree.

The central government has recognized that Hong Kong is a jewel not to be lightly discarded. In April, the CSRC announced several measures to encourage high-profile companies from the mainland to list on the Hong Kong Stock Exchange. This included allowing real estate investment trusts to list and deepening the integration with mainland exchanges via Stock Connect.

In recent weeks, companies, including the number two bottled water company, China Resources Beverage, and Alibaba back cloud services company, Quiniu, have received approval to move forward with their IPOs, building on the sense of momentum. According to media reports, private automotive giant Chery is also considering a $7 billion IPO in Hong Kong.

For Hong Kong to continue to thrive, however, the central government must resist the temptation to stifle the free-market ethos that has been part of the city’s culture and attraction for decades. According to media reports, the CSRC recently withdrew the approvals for pending IPOs for several bubble tea chains, Mixue, Guming, and Auntea Jenny, that had planned to raise over $1.5 billion between them.

Now, regulators undoubtedly had solid reasons to believe that bubble tea mania risked leading to overcapacity and profit erosion as the well-funded chains scrambled to throw up shops across the PRC. However, those kinds of capital allocation decisions are best decided by informed investors rather than central planning.

If China wants to maintain Hong Kong’s status as a friendly portal for global fund managers to make bets on the future of China, it must be careful to employ a light touch and preserve the city’s distinctive rule of law in all commercial matters.

After all, a surplus of sweet boba tea is a small price to pay to nurture the next generation of China’s global champions.

Read the full article here