HONG KONG: Asia’s markets rally stuttered on Friday (Nov 8) after early gains as traders struggled to keep up with another Wall Street record following the Federal Reserve’s interest rate cut, while they were also weighing the outlook with another Trump administration.

Traders were also awaiting the end of a week-long meeting of key Chinese officials who have been hammering out a major stimulus package for the world’s number two economy with an eye on the US election result.

While there are concerns that another four years of Donald Trump could see a rise in tensions between Beijing and Washington, investors are optimistic that his plans to slash taxes and push through more deregulation will boost companies’ bottom lines.

There are worries that the Republican’s policies could stoke inflation again, dealing a blow to the Fed’s long-running battle against prices.

But central bank boss Jerome Powell added to the upbeat mood Thursday by insisting that the outcome of this week’s vote would have no impact on policymakers’ decision-making, adding that they would make their decisions based on data.

After the policy board cut rates 25 basis points to 4.50 to 4.75 per cent, as expected following September’s 50-point reduction, Powell said: “We don’t guess, we don’t speculate, and we don’t assume.”

The Fed’s post-meeting statement said that “labour market conditions have generally eased” since earlier in the year and noted progress in bringing inflation down to its two percent target.

Traders are now trying to ascertain the outlook for another cut in December.

“With Powell squarely focused on labour, the combination of an inflation rate now in the realm of the Fed’s target means it can easily justify further cuts,” said Robert Tipp and Tom Porcelli at PGIM Fixed Income.

“Although uncertainty abounds, the Fed’s year-end 2025 forecast for a Fed funds rate of 3.5 per cent is still a useful starting point for where this cycle is going.”

On Wall Street, the S&P 500 and Nasdaq rallied again to hit fresh records, helped by strong performances by tech titans Apple, Google parent Alphabet and Facebook’s Meta.

Asia took up the baton in early trade but some markets fell away in the afternoon.

Tokyo, Sydney, Singapore, Wellington, Taipei and Jakarta rose.

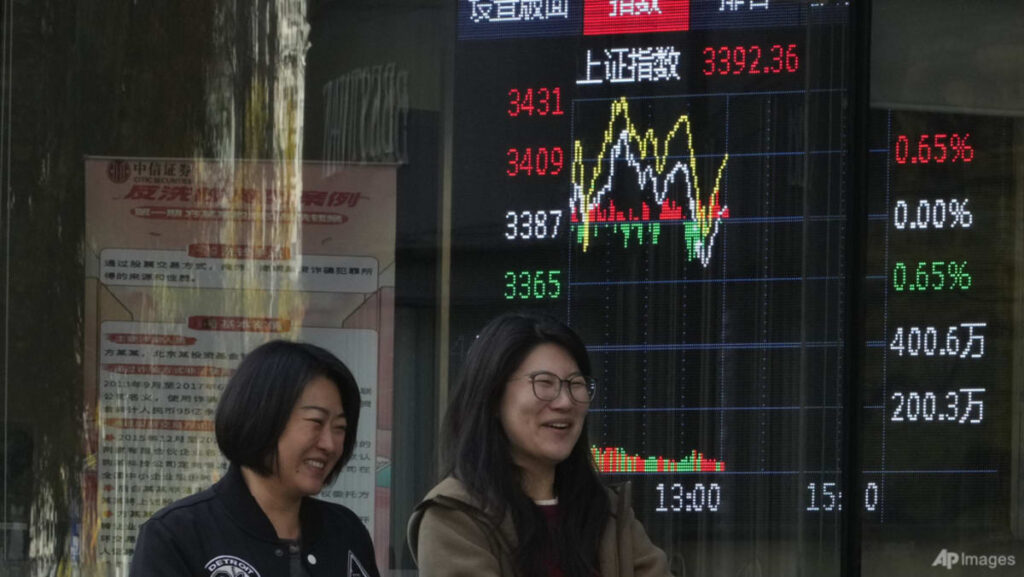

But Hong Kong and Shanghai turned negative along with Seoul, Manila, Mumbai and Bangkok.

On currency markets, the dollar fell against the yen, extending Thursday’s losses in reaction to the Fed cut, while bitcoin hit another all-time peak of more than 76,956 on hopes of more support from a crypto-friendly Trump White House.

Read the full article here