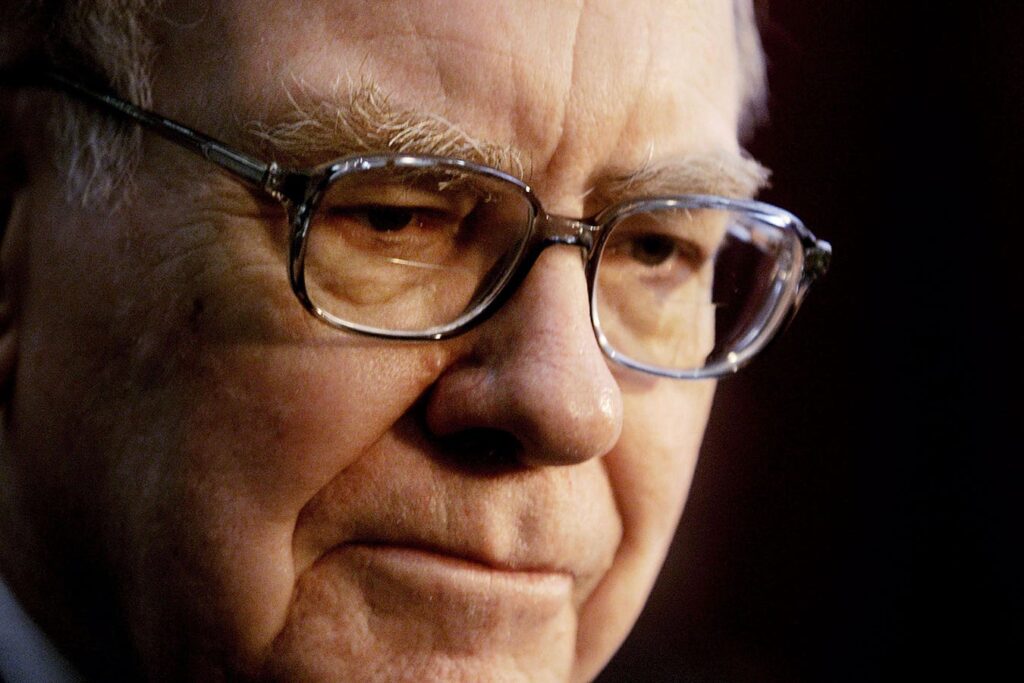

Berkshire Hathaway’s (BRK/A, BRK/B) third-quarter 13F was filed after the market closed on November 14. This filing gives us a quarterly opportunity to observe what Warren Buffett and his investment team of Todd Combs and Ted Weschler are doing within Berkshire’s publicly traded equity portfolio. Berkshire has a large stable of wholly-owned entities, but this report provides us with the details of the U.S. publicly traded stock portion of their investments. Berkshire’s third-quarter earnings were recently reported, containing significant information about the extensive portfolio of wholly-owned operating companies and disclosures of the reduction in Apple (AAPL) and Bank of America (BAC) shares. A deep dive into the third-quarter earnings report is available here.

Berkshire’s $266 billion investment portfolio consists of 40 companies, down one from last quarter. Berkshire was again a net seller of publicly traded stocks during the quarter. The top five holdings, in order of the size of holding, are Apple (AAPL), American Express (AXP), Bank of America (BAC), Coca-Cola (KO), and Chevron (CVX). The top 5 holdings account for over 71% of the total portfolio, down from 76% in the first quarter. Notably, despite the enormous sales of Apple, the investment portfolio remains very concentrated, with almost 90% of assets in the top ten holdings.

Though the news was already known from the earnings disclosures, the most surprising information was that Berkshire Hathaway sold over $20 billion of its stake in Apple (AAPL) in the third quarter after paring it by $90 billion in the first half of the year. Before the initial sale, Apple stock comprised over 50% of its publicly traded portfolio but is now at around 26%. The continued trimming was a shock since Buffett said at the annual meeting that Apple is an even better business than the long-held Berkshire holdings of American Express (AXP) and Coca-Cola (KO).

Due to its top five holdings, plus Occidental Petroleum (OXY) and Kraft Heinz (KHC), the portfolio remains considerably overweight in financials, consumer staples, and energy relative to the S&P 500. The Berkshire portfolio was overweight technology due to its massive Apple stake, but the recent selling has taken technology to an underweight. Berkshire controls 27% of the outstanding shares in Occidental, which, combined with Chevron, leads to a significant energy sector overweight. A deeper analysis of the probable reasons behind the Occidental purchase can be found here. Berkshire has only one small holding in the industrial sector and no real estate companies or utilities. However, Berkshire’s wholly-owned entities include a large railroad, Burlington Northern Santa Fe, and multiple regulated utilities and pipelines.

Because the 13F does not include international stocks, Berkshire Hathaway initially announced the acquisition of about 5% of five Japanese trading companies at the end of August 2020. These holdings are Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp. Buffett revealed in April 2023 that Berkshire increased its stakes in these companies to 7.4%. Buffett indicated that these were intended to be long-term holdings, and Berkshire may still increase its stake to 9.9%.

Berkshire added two new holdings, Domino’s Pizza (DPZ) and Pool Corporation (POOL). Both were relatively small additions at 0.2% and 0.05% of the portfolio, respectively. Domino’s Pizza manages franchise and company-owned pizza stores in the U.S. and internationally. Pool Corporation distributes swimming pool-related products worldwide. Pool Corporation was a COVID-era darling and remains about 38% below its 2021 high.

Berkshire added to its positions in Heico Corporation (HEI/A) and Sirius XM Holdings (SIRI). Some of the Sirius XM Holdings (SIRI) came from the simplification of Liberty Media – SiriusXM Class C (LSXMK) and Liberty Media – SiriusXM Class A (LSXMA) share classes.

Floor & Decor Holdings (FND) was eliminated from the portfolio in the quarter after being trimmed last quarter.

Within financials, Berkshire trimmed its Capital One Financial (COF), Bank of America (BAC), and NU Holdings (NU). Warren Buffett is regarded as one of the greatest bank stock investors ever. Hence, the reduction in exposure to the banking sector is notable, but 42% of the stock portfolio remains in financial companies.

As noted previously, Berkshire reduced its Apple (AAPL) holdings. In addition, Charter Communications (CHTR) and Ulta Beauty (ULTA) were trimmed. Notably, Ulta Beauty was newly added to the portfolio last quarter.

This analysis looks at the Berkshire portfolio across a host of measures, including 12-month forward estimated: price-to-earnings (P/E), price-to-sales (P/S), return-on-equity (ROE), enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA), price-to-book (P/B), dividend yield, current debt-to-EBITDA, current free cash flow yield, current operating margin, and long-term earnings-per-share growth consensus estimates.

Overall, the Berkshire portfolio analysis reflects a cheaper price-to-earnings valuation than the S&P 500 while having better profitability as measured by return on equity and operating margin with similar debt levels. The long-term (next 3 to 5 years) consensus earnings-per-share growth rate is expected to be lower than the S&P 500. Buffett’s preference for high-quality companies that generate significant cash flows is evident from the better profitability metrics combined with a superior free cash flow yield.

Berkshire was a net seller of stocks in its portfolio for the eighth quarter in a row, with net sales of over $34 billion in publicly traded stocks. Between the stock sales and the cash generated from Berkshire’s businesses, the company has amassed a record level of cash and equivalents of over $300 billion. Perhaps more tellingly, the cash stockpile relative to the size of Berkshire Hathaway is at 28%, the highest level since at least 1990. At the annual meeting, Buffett said there were few significant opportunities to invest the cash at an attractive expected return: “But I don’t mind at all, under current conditions, building the cash position. I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.” Buffett’s actions indicate that this opinion still holds.

Read the full article here