TRADE TIES, TRUMP TENSIONS

For all the friction over Beijing’s support for Russia and its actions in the Indo-Pacific, and Berlin’s vocal criticism of China’s human rights record and state-subsidised industrial policy, the two countries remain bound by a vast and mutually advantageous commercial relationship.

China bought US$95 billion worth of German goods last year, around 12 per cent of which were cars, Chinese data shows, putting it among the US$19 trillion economy’s top 10 trading partners. Germany purchased US$107 billion of Chinese goods, mostly chips and other electronic components.

But Berlin stands out for China as an investment partner, having injected US$6.6 billion in fresh capital in 2024, according to data from the Mercator Institute for China Studies. This accounts for 45 per cent of all foreign direct investment into China from the European Union and the United Kingdom.

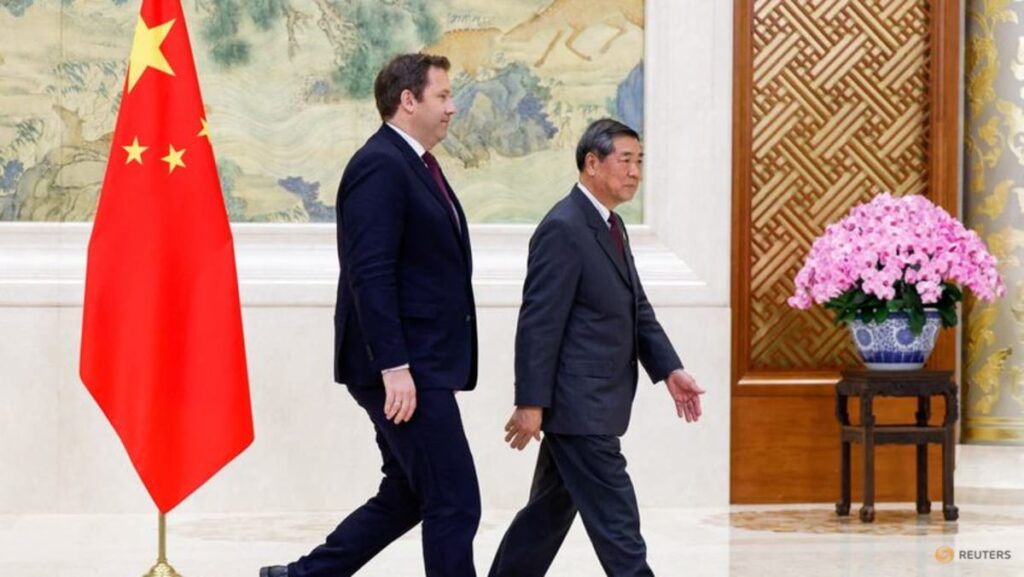

Li said he “hoped Germany would maintain a rational and pragmatic policy toward China, (and) eliminate interference and pressure”, during their meeting in South Africa, which is hosting the first G20 summit on the continent.

Germany is yet to publish a readout of the meeting.

For Germany, China represents a practically irreplaceable auto market, and is responsible for almost a third of German automakers’ sales. German chemicals and pharmaceuticals firms also have a large presence in the country, although they are facing increasing pressure from domestic competitors.

“China is willing to work with Germany to seize future development opportunities … in emerging fields such as new energy, smart manufacturing, biomedicine, hydrogen energy technology, and intelligent driving,” Li said.

Read the full article here