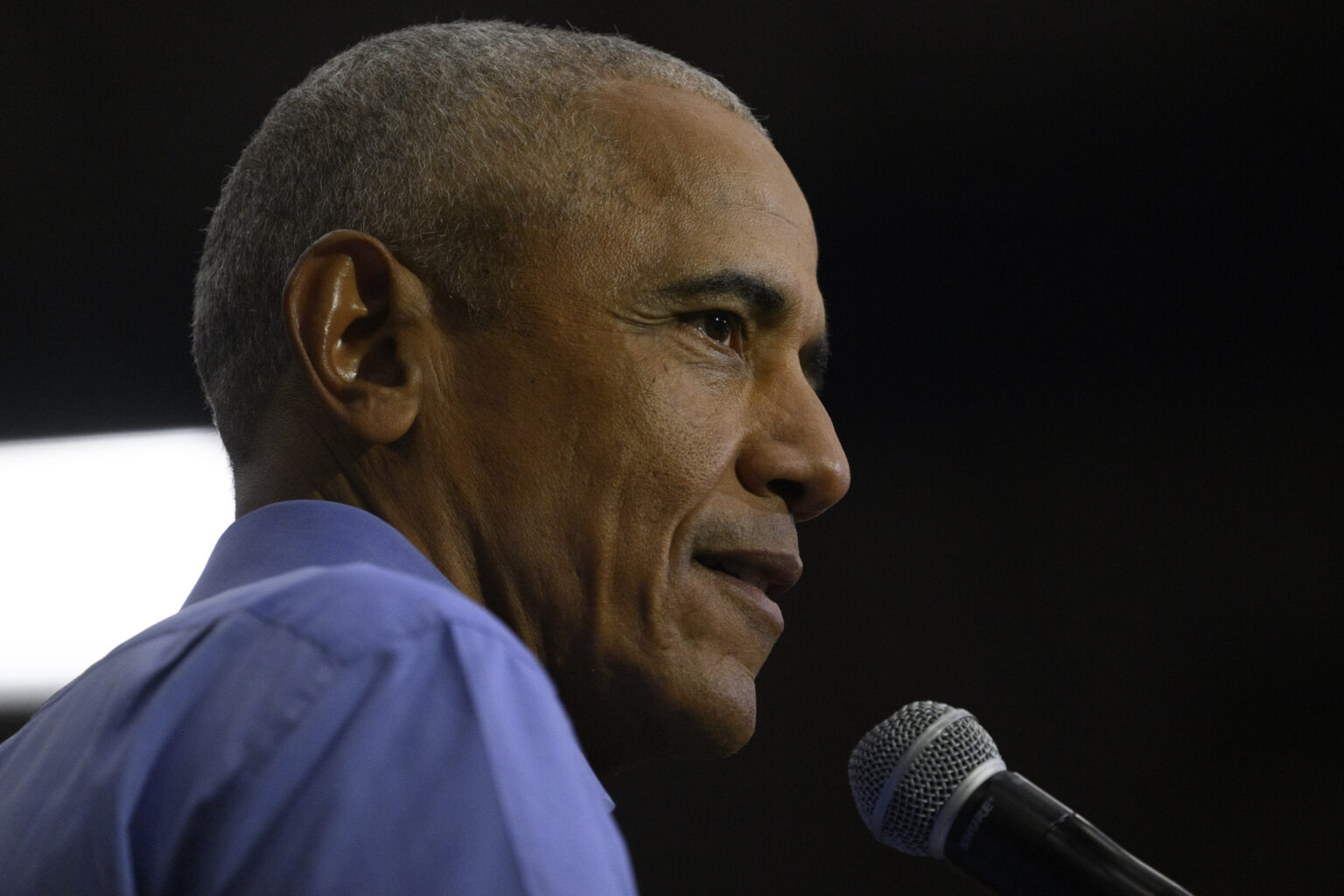

Former President Barack Obama delivered a sustained attack on Donald Trump’s record and policies in Pittsburgh, Pennsylvania, on Thursday as Kamala Harris battles with Trump over the crucial swing state before polling day.

Polls show a neck-and-neck race between Vice President Harris and former President Trump. A new Quinnipiac poll released on Wednesday shows Harris up three points with likely voters in Pennsylvania.

While Obama made no outright falsehoods, Newsweek counted several claims he made in Pittsburgh that deserve further scrutiny.

“He wants the middle class to pay the price for another huge tax cut that would mostly help him and his country club buddies.”

This is a reference to Donald Trump’s Tax Cuts and Jobs Act. The act, due to expire in 2025, was enacted under his presidency in 2017. It creates a single flat corporate tax rate of 21 percent, down from 35 percent.

If elected, Trump says he plans to extend his tax cuts and go even further by eliminating taxes on tips and Social Security benefits and by cutting the corporate tax rate again, dropping it from 21 percent to 15 percent.

While the tax cuts may benefit middle-class households, analysts say the greatest proportional benefit will go to the wealthy. According to the Penn Wharton Budget Model, an initiative meant to analyze the fiscal impact of public policies, a middle-class household with $80,000 in income would gain $1,700 after taxes under Trump’s plan, while a household with $14 million in income would gain $377,000 under Trump.

The Penn Wharton Budget Model estimates the plan would add $5.8 trillion to the national debt. While it said its estimates of the benefits show that low, middle, and high-income households would fare better under the plans on a conventional basis, the gains and losses “do not include the additional debt burden on future generations who must finance almost the entirety of the tax decreases.”

An analysis by the Tax Policy Center from 2017 found that higher-income households would receive “larger average tax cuts as a percentage of after-tax income” and that the largest cuts, as a share of income, went to taxpayers in the 95th to 99th percentile. The bill would reduce taxes “on average for all income groups.”

“Donald Trump was told that Mike Pence was in the Capitol about 40 feet from an angry mob chanting ‘Hang Mike Pence,’ and his response was ‘So what?'”

This comes from special counsel Jack Smith’s election subversion investigation. Late last month, Smith’s office filed the 165-page document that laid out new evidence against Trump in the election subversion case, in which the former president faces four felony counts.

A redacted version of the document was filed on the public docket less than a week later, removing any sensitive information and dozens of names related to Smith’s investigation.

One entry read that an aide had spoken to Trump, trying to ensure then-Vice President Mike Pence’s safety during the riot at the U.S. Capitol on January 6, 2021.

“Upon receiving a phone call alerting him that Pence had been taken to a secure location [redacted] rushed to the dining room to inform the defendant [Trump] in hopes that the defendant would take action to ensure Pence’s safety,” it read.

“Instead after [redacted] delivered the news, the defendant looked at him and said only, ‘So what?'”

Smith’s briefing states that the government does not intend to use Trump’s discussions with White House staff at that time at trial as evidence, only providing it in the briefing as “necessary context.”

Video of rioters chanting “Hang Mike Pence” was played to the House Select Committee in 2022 investigating the Capitol attack, as reported by The Washington Post.

“What he’s proposing is basically a Trump sales tax that could cost the average family almost $4,000 a year.”

This claim has been repeated throughout the Harris campaign. It’s based on an analysis by a left-leaning think tank, the Center for American Progress (CAP). It said Trump’s plans to increase tariffs on imported goods by 10 to 20 percent—60 percent on all imported goods from China—would amount to a $3,900 tax increase for middle-income families.

However, other estimates, such as the Peterson Institute for International Economics, say the 20 percent tariff proposal would cost the typical American household just over $2,600 annually.

“When it comes to health care, you heard it in the debate, Donald Trump’s got one answer: Ending the Affordable Care Act.”

Trump has said throughout his campaign that he would not end the Affordable Care Act, referred to by opponents as Obamacare, despite his repeated efforts throughout his presidency to dismantle it.

“I’m not running to terminate the ACA, AS CROOKED JOE BUDEN DISINFORMATES AND MISINFORMATES ALL THE TIME, I’m running to CLOSE THE BORDER, STOP INFLATION, MAKE OUR ECONOMY GREAT, STRENGTHEN OUR MILITARY, AND MAKE THE ACA, or OBAMACARE, AS IT IS KNOWN, MUCH BETTER, STRONGER, AND FAR LESS EXPENSIVE,” Trump wrote on Truth Social in March.

However, Trump was quizzed about this directly at his debate with Harris in September, which appeared to suggest that if elected, he might implement a different policy if his administration found a replacement.

“Obamacare was lousy health care. Always was,” Trump said at the debate.

“It’s not very good today. And what I said, that if we come up with something, we are working on things, we’re going to do it, and we’re going to replace it.”

Newsweek reached out to a media representative for Trump via email for comment.

“Why were the number of immigrants basically the same when you left office as when you took office?”

According to government data, this is misleading. It’s true that between when Trump took office in 2017 and when he left in 2021, the number of undocumented migrants estimated to be living in the United States had not changed much. However, it had decreased, if not by much, relative to historical data.

Data from the Department of Homeland Security from 2018 and 2024 shows that the estimated unauthorized immigrant population was 11.4 million in January 2017, decreasing to 10.5 million by January 2020. The DHS data did not record results for January 2021 due to “substantial challenges related to COVID-19” that affected the reliability of the data source, the U.S. Census Bureau’s American Community Survey.

A recent Pew Research Center analysis on unauthorized immigration, based on augmented U.S. Census Bureau data, stated that the population was 10.5 million in 2021.

However, the unauthorized immigrant population has arguably been stagnant throughout nearly two decades of government. According to DHS analysis, the population has moved between estimates of 10.5 million and around 12 million over the last 19 years. While the number increased between 2020 and 2022, it was still below record highs of around 12.2 million in 2007, estimated by Pew.

Newsweek reached out to a media representative for Obama via email for comment.

According to Census Bureau data, the overall number of foreign residents in the United States, including U.S. and non-U.S. citizens, increased from 43.7 million in 2016, the first year of Trump’s government, to 45.2 million in 2021.

Southwest border encounters increased between fiscal years 2017 and 2019, from 415,517 to 977,509, according to figures from U.S. Customs and Border Protection.

The figure dropped to 400,651 in 2020, with a steep decrease in April 2020 as the COVID-19 pandemic began. The following year, encounters increased to more than 1.7 million.

Read the full article here