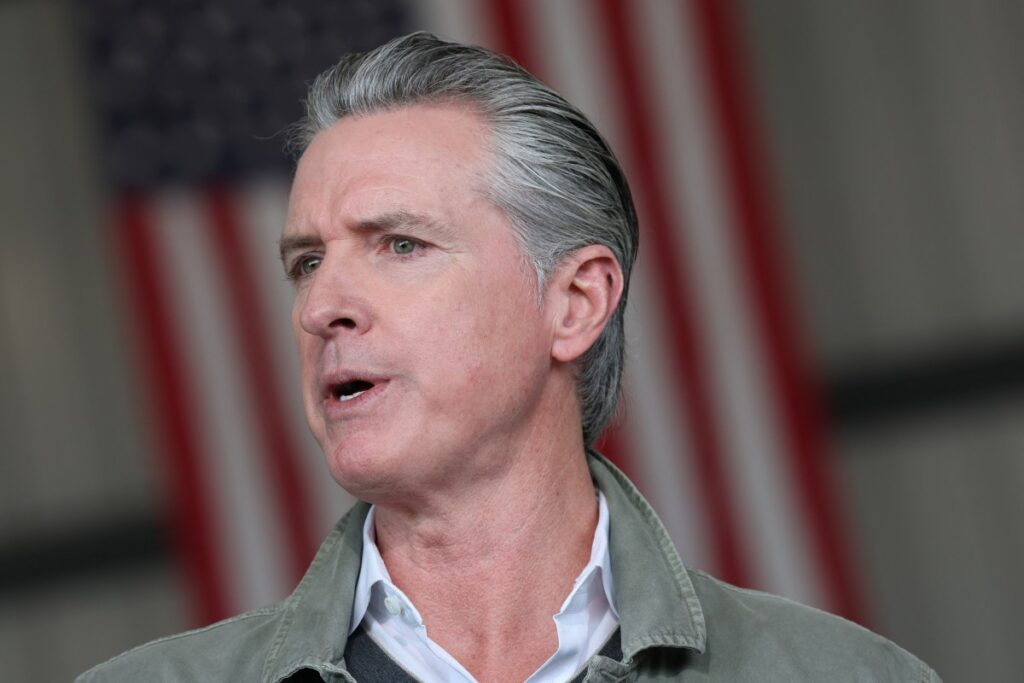

California Governor Gavin Newsom has announced plans to offer 12 months of mortgage relief for homeowners affected by the devastating Los Angeles fires of January 2025.

“If you lost your home, we’re offering 12 months of mortgage relief up to $100,000 that you won’t need to repay later,” he wrote in a post on X on Thursday. “We’ll keep doing what’s necessary to help survivors recover,” he added.

But the announcement was met with anger by many social media users accusing the governor of failing to do what they think would help victims the most—speed up the reconstruction process by cutting down on regulations known to be slowing down rebuilding efforts.

Newsweek contacted Newsom’s office for comment by email on Friday early morning.

What Victims Are Dealing With, One Year Later

The wildfires that ravaged Los Angeles County last year killed 31 people and destroyed about 13,000 homes. For those residents who had been dropped by their insurers in the months preceding the blazes, and for those whose insurance did not completely cover the damages, the process of rebuilding their homes has been full of hurdles.

Chris Thornberg, an economist at Beacon Economics, told Newsweek that he believes that “fewer than ten homes” have been rebuilt in the neighborhoods affected by the wildfires.

Hannah Jones, senior economic research analyst with Realtor.com, added that “rebuilding after the Palisades and Eaton fires has been slow and uneven, with only a very small share of destroyed homes fully rebuilt so far and many lots still vacant or in early construction stages.”

“While hundreds of permits have been filed, delays related to insurance, and financing gaps have prevented many homeowners from moving forward,” she explained. “Rebuilding is also slowed by permitting complexity, labor shortages, high construction costs, and the emotional toll on residents deciding whether to return.”

On top of losing their homes, many were facing the grim prospect of continuing to pay mortgages on their damaged, unlivable properties. But on January 18, 2025, Newsom announced that the state was working with major lenders to offer mortgage relief to some of the victims.

In September of the same year, he signed into law AB 238, a bill which extended mortgage forbearance for victims up to 12 months.

What Newsom’s Latest Announcement Means For Victims

The major expansion of the mortgage relief program announced by Newsom on Thursday means that wildfire victims will now be able to qualify for one year of mortgage payments, paid directly to their mortgage servicers.

According to Newsom’s office, the update represents a fourfold increase of the program, which previously offered three months of relief.

Homeowners who are currently on their mortgage, in forbearance, or behind on payments are all eligible to receive the payments. Families who previously received three months of assistance will be offered additional support, bringing total assistance to a full year, according to Newsom.

Additionally, the program will now cover up to $100,000 in payments, up from the previous $20,000.

Income limits have also been raised, a move that would allow more homeowners to receive assistance, according to Newsom.

“As these communities continue rebuilding, we’re not going anywhere. The state of California is a committed partner every step of the way on the road to recovery. This disaster was unprecedented and demanded flexibility and real-time action,” Newsom said in a statement.

“We’ve been on the ground, listening and adjusting to meet people’s evolving needs. That’s why we’re expanding this program—to close the gap between relief and long-term recovery, and make sure folks get the help they need to move forward.”

Affected homeowners should apply as soon as possible, according to Newsom’s office. For more information, readers can visit CalAssistMortgageFund.org or call 800-501-0019.

Where Does This Leave Affected Neighborhoods

A full recovery for the areas affected by the January 2025 wildfires “is likely to take many years, and some neighborhoods may never fully return to their pre-fire state,” Jones said.

“One growing concern is the risk of investors buying fire-damaged lots at discounted prices, which can accelerate rebuilding but also raise the risk of displacement and loss of long-standing community ties,” she added. “Overall, recovery is less about speed and more about financial, emotional, and institutional capacity, which remains stretched even a year after the fires.”

According to Thornberg, a full recovery of the affected Los Angeles neighborhoods “will likely take a decade, minimum,” he said.

“Anecdotal evidence suggests something that we all forget—your standard person is simply not equipped to build a home from the ground up. Go back to the complexity of the building process, not just in the regulatory regime, but just in general—building housing is REALLY REALLY complicated,” he continued.

“People simply have no idea how much things should cost, and even what their options are—they are entirely dependent on others to make it happen. General contractors are hard to find and harder to pin down, and many are not exactly the most honest. People don’t understand their choices and the costs they face. This is why specialists build homes, not your standard person,” he added.

Another big issue, he said, is that many people in the affected neighborhoods were underinsured. “They didn’t get enough from the insurance to cover the full cost of rebuilding,” he said.

“Costs have increased sharply in recent years and I think that many folks didn’t up their coverage enough in response. Now they have to come up with the extra cash needed and that may be slowing them down as well.”

Read the full article here