The 2024 election results are likely to move financial markets, that’s because the impact of policies is reflected in the trajectories of corporate profits. However, it’s not only the Presidency that matters. Markets will closely watch control of the House and Senate as well to determine how likely it is that either party’s agenda is implemented. Historically the U.S. market has tended to rise over Presidential terms, regardless of who is President, but political gridlock with less policy change may be the outcome markets prefer.

Have The Markets Priced The Election In?

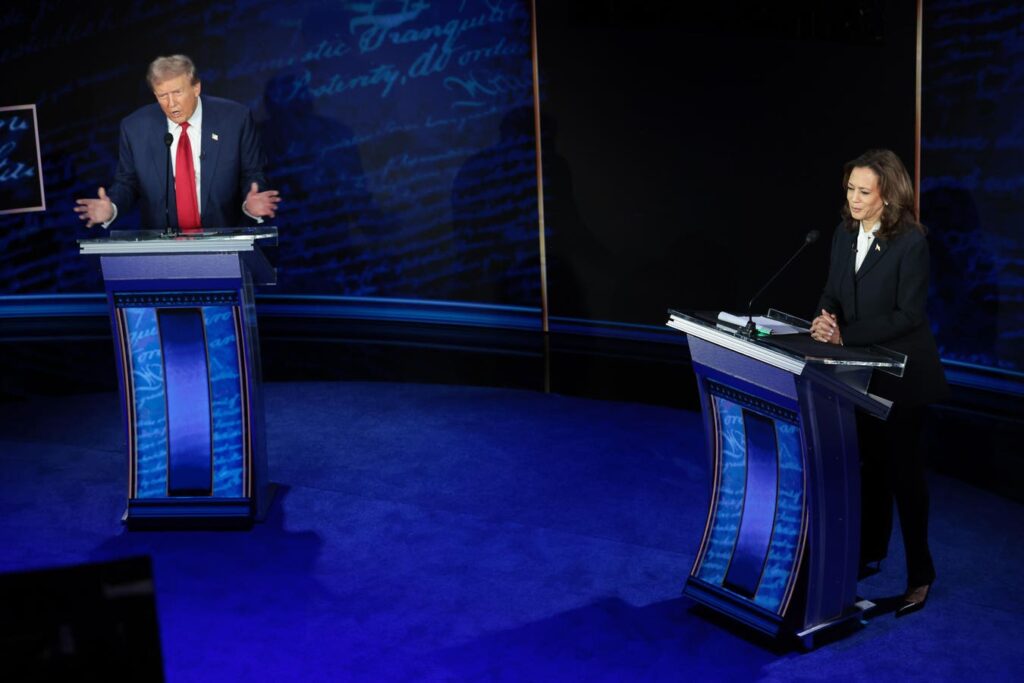

It’s important to note that markets are already pricing likely electoral outcomes based on current expectations of who might win. For example, prediction markets such as Kalshi and Polymarket currently imply that Donald Trump is more likely to win the 2024 election than Kamala Harris, with a roughly 65% chance of victory currently.

This is despite polling in most swing state polls being finely balanced. Therefore, even though markets are likely to move either way, there may be a little more surprise, and hence movement, from financial markets in the event of a Harris win.

Markets May Prefer Political Gridlock

However, regardless of the Presidential election outcome, political gridlock appears likely. That’s because on current polling, the Republican appears likely to win the Senate and the Democrats appear likely to win the House. Of course, these predictions may not hold, but the most likely outcome is that whoever is President has to work with either a House or Senate controlled by a different party and that will likely mean that policy agendas are harder to implement.

There’s also some evidence, based on history, that the markets may rise in the few days leading up to the election regardless of its outcome.

Market Impact Of Specific Presidential Policies

Researchers at the Bank of Italy in a 2024 regression based study, suggest that a Trump win in 2024 is more likely associated with volatility in the bond market, higher stock prices with lower volatility and lower oil prices. This may match with Trump’s policy goals, but often these correlations are hard to pin down with certainty.

More generally, the U.S. stock market has historically performed better under Democratic Presidents historically by a wide margin of over 10% a year. However, this may be because two major economic crashes (1929 and 2008) occurred under Republican administrations, and the recoveries from those crashes were under Democratic Presidencies. That’s according to a paper published in 2017 by Rob Arnott, Bradford Cornell and Vitali Kalesnik. The Nixon Presidency also saw negative stock market returns, due, in part, to elevated inflation.

What To Expect From The Markets

Historically the U.S. stock market has tended to rise during most Presidential terms. These results are assessed by Darrow Wealth Management, which also finds that political gridlock, where different parties control the Presidency, Senate and House are historically the best outcome for markets.

The Electoral Cycle And The Stock Market

One near-term risk for investors though, is the Presidential election cycle in markets. Historically the U.S. market has tended to perform better in pre-election periods, such as this year, with the S&P 500 currently up by 23%, and then show weaker returns in the years after elections. That trend could dampen market returns 2025 after the election.

However, the Presidency has not historically been a primary driver of the stock market, with returns tending to be positive over time, absent a financial crisis, regardless of who holds the office.

Read the full article here