Kawoosa pointed out that in most cases, the chip IP remains with international firms.

“If you ask me, will India be a top global hub for semiconductors and chips? The answer is no as of now,” Kawoosa said.

Semiconductors have become a strategic asset for countries and international firms heavily protect their chip design architecture to see that it isn’t replicated, he added.

Around 20 per cent of revenue earned by Indian chip design firms goes towards licensing IP used in their designs, said Chitranjan Singh, founder and CEO of semiconductor firm Ananant Systems.

The US holds a majority of the core chip design IPs in the world. It received more than 37 per cent of the global semiconductor IP revenue in 2025, as per market research firm Cognitive.

However, this is not stopping Indian firms, including Saankhya Labs, InCore Semiconductors, and Agrani Labs, from building their own chips.

“More engineers are building their own companies, creating Indian IP. That’s a very positive shift,” Vikram Gupta, founder and managing partner at Indian venture capital (VC) firm IvyCap Ventures told CNA.

Another missing element is patient, long-term capital from private investors, said Singh of Ananant Systems.

Developing a core IP design can take around four years, followed by another two to three years to turn it into a product – all without revenue, he said, noting that Indian VC firms, which back early-stage companies, often lack the patience to fund such long timelines.

Singh was able to sustain his company during the initial years without any revenue after raising a first cheque of US$6 million from a US-based investor.

However, this is changing.

VC investment in Indian semiconductor startups has jumped more than 25-fold over the past four years to reach US$569 million in 2025, according to data insights firm Tracxn.

“VC firms like Speciale Invest, Peak XV and Blume Ventures are now backing startups in chip design, IP, and AI hardware, reflecting growing conviction in the sector’s commercial viability,” said Shweta Kohli, president and CEO of industry body Startup Policy Forum.

While the Indian government offers up to 150 million rupees (US$1.6 million) in funding for chip design under the Design Linked Incentive (DLI) scheme, the support is reimbursed rather than upfront capital.

The government plans to introduce a new version of the DLI scheme that would provide upfront funding, either in exchange for equity or as a loan.

IvyCap Ventures’s Gupta said he expects more government funding for the semiconductor sector in India’s upcoming Budget 2026 on February 1.

SIZE DOES MATTER IN CHIPS

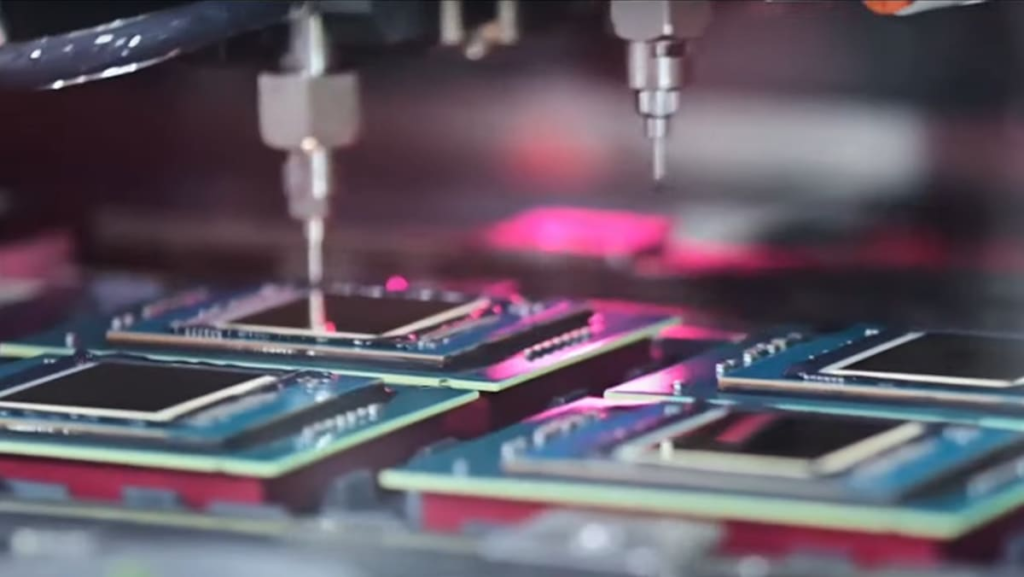

In January, India’s MeitY Minister Vaishnaw said that the country will be able to produce 7-nanometer (nm) chips by 2030 and 3-nm chips by 2032.

The upcoming Tata–PSMC fab in Gujarat will be able to manufacture chips above 28nm. These are called mature chips, and they are simpler to produce than advanced and smaller 7-nm and 3-nm chips.

Read the full article here