Japan is the country with the strongest influence and visibility in American media and political spheres, according to a new report. It is also the top foreign investor in the U.S., highlighting how influence and economic engagement are closely intertwined.

Japan comes out No. 1 in the 2024 BGR Impact Index, which ranks countries based on their recognition and reputation in the U.S. The other countries in the top 10 are, in order, Germany, South Korea, Canada, Italy, the United Kingdom, France, Australia, the Netherlands and Switzerland.

The index is produced by BGR Analytics, a division of the Washington D.C.-based lobbying and communications firm BGR Group. BGR’s analysis is derived from analysis of traditional, news and social media data. It is designed to provide foreign governments insight into how they are perceived in the U.S. and how their countries compare to economic rivals.

Japan clinched the top spot by securing a top 10 ranking in 16 of 25 categories and first in five categories, including favorable social media sentiment.

Countries with strong influence and visibility in the U.S. are often major sources of foreign direct investment. This influence can facilitate smoother entry into the U.S. market and increase the likelihood of successful investments and partnerships. When countries are seen as stable and reliable partners, U.S. businesses and policymakers are more inclined to welcome and support their investments.

“FDI plays a huge role in winning hearts and minds among U.S. politicians and the labor force, especially at the state and local level,” says Frank Ahrens, head of analytics at BGR.

“But this does not always translate to nationwide goodwill toward foreign investors,” he adds, saying the public is often suspicious of foreign ownership of American assets, especially by countries such as China. “Part of this is fueled by anti-China sentiment, and non-Chinese Asian countries need to work hard to build their national brands in the U.S.,” Ahrens says.

However, seven of the top 25 countries in the index are Asian. “Asia has terrific manufacturing and exporting might and a history of investment in the U.S., but not all of that has been positively received,” Ahrens says. “Europe had a big head start on Asia in making a name for itself in the U.S. But I think the index results reflect the reality of Asia’s growing clout in and focus on the U.S. market and engagement in U.S. politics.”

China, which is the subject of increasing oversight of its investments in the U.S., ranks 15th in the index.

“China at No. 15 may look like a good ranking, but consider that it has the world’s second-largest population and GDP, is ranked No. 1 in our index in cultural heritage, number of companies in the U.S. and international mobility of students and then ask why it’s not ranked higher,” Ahrens says. “It’s because China gets hammered in the online news and social media sentiment rankings, as well as in categories such as human rights and institutional transparency.”

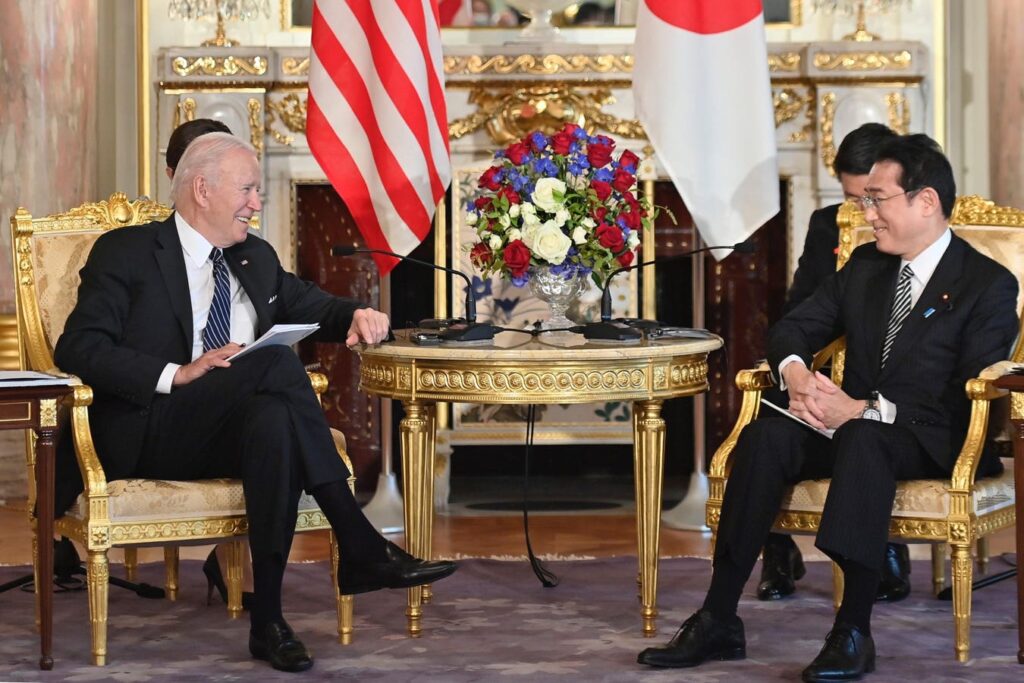

Japan’s economic clout and investments in the U.S. sparked similar concerns in the 1980s and 1990s but public and political sentiment eventually shifted in a favorable direction.

“The U.S.-Japan economic partnership is very strong and presents an enormous opportunity for businesses and financial institutions in both countries,” says Ken Rivlin, co-head of the International Trade Group at law firm A&O Shearman in New York. “We’re seeing increased U.S. interest in partnering with Japanese businesses and vice versa.”

“At a time when U.S. relations in other parts of the world are less stable — with China and China-related issues being front and center on that point — a reliable ally that’s known for quality and stability and innovation is very appealing,” Rivlin adds.

Japan is the single-largest overseas investor in the U.S., constituting 15% of total cumulative FDI holdings as of the end of 2023, according to data from the Bureau of Economic Analysis analyzed by the FDI advocacy group Global Business Alliance. Canada is the second-largest investor, with 14% in FDI US stock, followed by Germany and the United Kingdom. Switzerland (No. 7) and Netherlands (No. 8) are other top investor countries that also perform strongly in the Impact Index.

While already substantial, Japanese investment is on the rise, growing 50% between 2018 and 2023 to reach $783 billion. Japan’s investments are also spread across the country, meaning its economic impact is felt widely. According to data from the Japan External Trade Organization, Japan is the No. 1 investor in 39 U.S. states.

Read the full article here