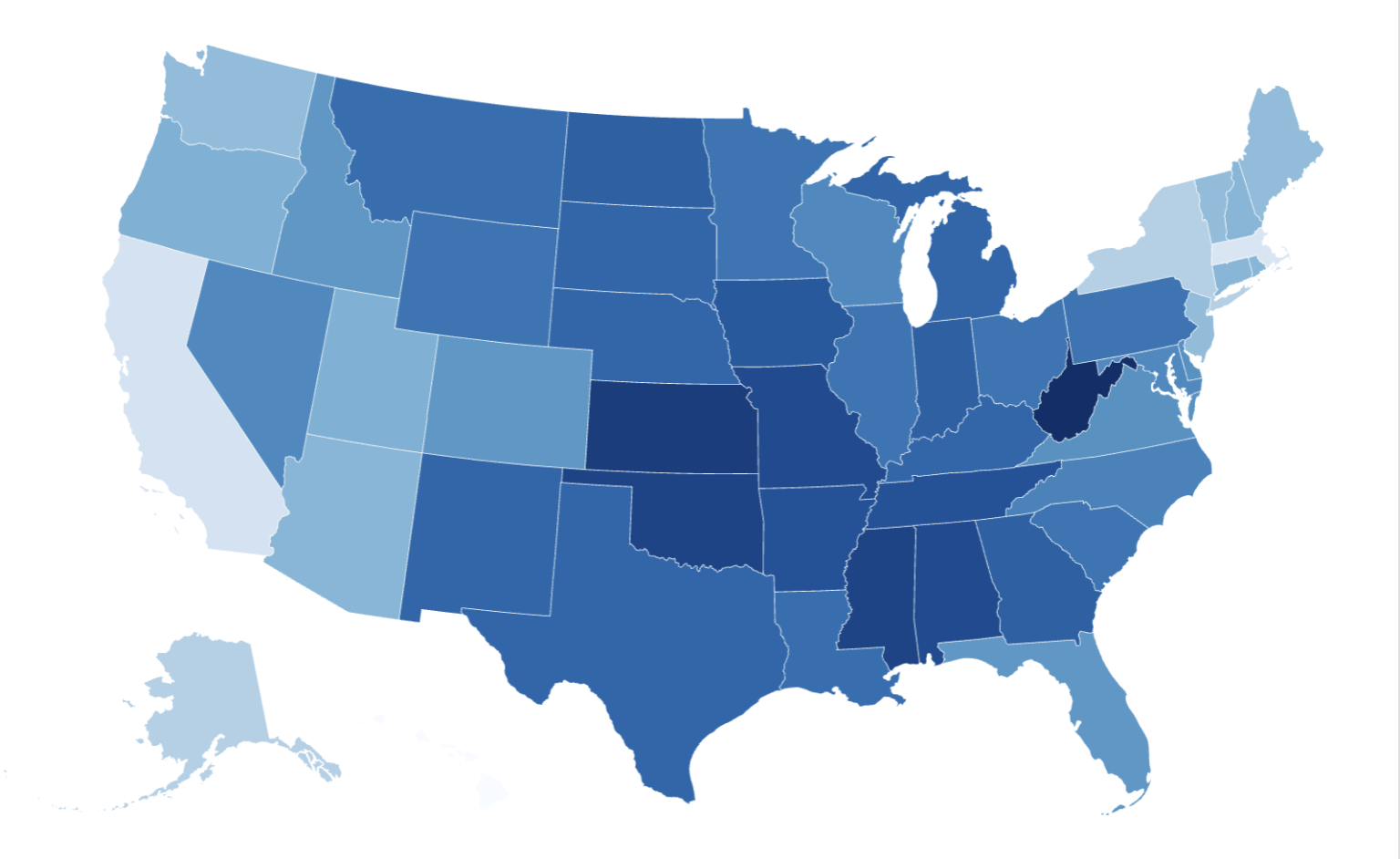

A majority of U.S. adults believe they need to save $1.46 million to retire comfortably according to a 2024 Northwestern Mutual survey—and a Newsweek map shows where the pot would last the longest.

The map is based on data from a new study by GOBankingRates which gives a state-by-state guide to the best places to retire, although the aspirational 1.5 million pot is a lot more than most Americans are actually able to put aside.

Why It Matters

The U.S. population is rapidly aging. By 2040, the number of Americans aged 65 and older is expected to more than double, reaching 80 million, while the number of those aged 85 and above will nearly quadruple, compared to the year 2000.

As the country braces for the so-called “silver tsunami” led by the Boomer generation, the U.S. retirement system is coming under immense strain, with the Social Security program’s fund reserves expected to be depleted by 2035.

The blessing of a longer life expectancy comes with the curse of widespread uncertainty over the future of Social Security, a potential rise in inflation, and possible economic shocks that could undermine Americans’ financial security.

According to a 2024 study by the National Council on Aging (NCOA), 80 percent of U.S. adults aged 65 and older were either financially struggling then or were at risk of economic insecurity in retirement.

What To Know

GOBankingRates calculated how long a retiree could live on a retirement savings pot of $1.5 million and their monthly Social Security benefits.

In Hawaii, Massachusetts, California, New York and Alaska, the $1.5 million would run out fastest; while in West Virginia, Kansas, Mississippi, Oklahoma, and Alabama, it would last for 50 years or longer.

This is how long the sum would last a retiree in each state, by decreasing order, considering the annual cost of living after Social Security.

1. West Virginia

- Annual cost of living after Social Security: $27,803

- How many years $1.5 million will last: 54

2. Kansas

- Annual cost of living after Social Security: $28,945

- How many years $1.5 million will last: 52

3. Mississippi

- Annual cost of living after Social Security: $29,426

- How many years $1.5 million will last: 51

4. Oklahoma

- Annual cost of living after Social Security: $29,666

- How many years $1.5 million will last: 51

5. Alabama

- Annual cost of living after Social Security: $30,207

- How many years $1.5 million plus Social Security will last: 50

6. Missouri

- Annual cost of living after Social Security: $30,327

- How many years $1.5 million will last: 50

7. Arkansas

- Annual cost of living after Social Security: $30,327

- How many years $1.5 million will last: 49

8. Tennessee

- Annual cost of living after Social Security: $30,928

- How many years $1.5 million will last: 49

9. Iowa

- Annual cost of living after Social Security: $31,168

- How many years $1.5 million will last: 48

10. Indiana

- Annual cost of living after Social Security: $31,709

- How many years $1.5 million will last: 47

11. Georgia

- Annual cost of living after Social Security: $31,829

- How many years $1.5 million will last: 47

12. North Dakota

- Annual cost of living after Social Security: $32,190

- How many years $1.5 million will last: 47

13. Michigan

- Annual cost of living after Social Security: $32,310

- How many years $1.5 million will last: 46

14. South Dakota

- Annual cost of living after Social Security: $32,310

- How many years $1.5 million will last: 46

15. Texas

- Annual cost of living after Social Security: $32,490

- How many years $1.5 million will last: 46

16. Nebraska

- Annual cost of living after Social Security: $32,610

- How many years $1.5 million will last: 46

17. Kentucky

- Annual cost of living after Social Security: $32,670

- How many years $1.5 million will last: 46

18. New Mexico

- Annual cost of living after Social Security: $32,670

- How many years $1.5 million will last: 46

19. Louisiana

- Annual cost of living after Social Security: $33,031

- How many years $1.5 million will last: 45

20. Montana

- Annual cost of living after Social Security: $33,331

- How many years $1.5 million will last: 45

21. Ohio

- Annual cost of living after Social Security: $33,872

- How many years $1.5 million will last: 44

22. Pennsylvania

- Annual cost of living after Social Security: $33,872

- How many years $1.5 million will last: 44

23. South Carolina

- Annual cost of living after Social Security: $34,052

- How many years $1.5 million will last: 44

24. Minnesota

- Annual cost of living after Social Security: $34,113

- How many years $1.5 million will last: 44

25. Wyoming

- Annual cost of living after Social Security: $34,173

- How many years $1.5 million will last: 44

26. Illinois

- Annual cost of living after Social Security: $34,233

- How many years $1.5 million will last: 44

27. North Carolina

- Annual cost of living after Social Security: $35,495

- How many years $1.5 million will last: 42

28. Maryland

- Annual cost of living after Social Security: $36,276

- How many years $1.5 million will last: 41

29. Wisconsin

- Annual cost of living after Social Security: $36,516

- How many years $1.5 million will last: 41

30. Nevada

- Annual cost of living after Social Security: $36,997

- How many years $1.5 million will last: 41

31. Delaware

- Annual cost of living after Social Security: $37,057

- How many years $1.5 million will last: 40

32. Virginia

- Annual cost of living after Social Security: $37,237

- How many years $1.5 million will last: 40

33. Idaho

- Annual cost of living after Social Security: $38,138

- How many years $1.5 million will last: 39

34. Florida

- Annual cost of living after Social Security: $38,379

- How many years $1.5 million will last: 39

35. Colorado

- Annual cost of living after Social Security: $38,559

- How many years $1.5 million will last: 39

36. Utah

- Annual cost of living after Social Security: $42,645

- How many years $1.5 million will last: 35

37. Oregon

- Annual cost of living after Social Security: $42,945

- How many years $1.5 million will last: 35

38. New Hampshire

- Annual cost of living after Social Security: $43,847

- How many years $1.5 million will last: 34

39. Connecticut

- Annual cost of living after Social Security: $43,967

- How many years $1.5 million will last: 34

40. Rhode Island

- Annual cost of living after Social Security: $44,387

- How many years $1.5 million will last: 34

41. Arizona

- Annual cost of living after Social Security: $44,628

- How many years $1.5 million will last: 34

42. Maine

- Annual cost of living after Social Security: $45,048

- How many years $1.5 million will last: 33

43. Washington

- Annual cost of living after Social Security: $45,108

- How many years $1.5 million will last: 33

44. Vermont

- Annual cost of living after Social Security: $45,409

- How many years $1.5 million will last: 33

45. New Jersey

- Annual cost of living after Social Security: $45,829

- How many years $1.5 million will last: 33

46. Alaska

- Annual cost of living after Social Security: $50,997

- How many years $1.5 million will last: 29

47. New York

- Annual cost of living after Social Security: $50,997

- How many years $1.5 million will last: 29

48. California

- Annual cost of living after Social Security: $63,795

- How many years $1.5 million will last: 24

49. Massachusetts

- Annual cost of living after Social Security: $65,117

- How many years $1.5 million will last: 23

50. Hawaii

- Annual cost of living after Social Security: $87,770

- How many years $1.5 million will last: 17

The data was compiled using the national average annual expenditures for people 65 and older, as reported by the Bureau of Labor Statistics’ 2023 Consumer Expenditure Survey data, and annual Social Security income based on the Social Security Administration’s (SSA) January 2025 data.

What’s Next

Most Americans save much less than the $1.5 million considered by GoBankingRates for their retirement.

A 2024 study by the Transamerica Center for Retirement Studies found that as of late 2023 workers had saved an estimated median $64,000 in total household retirement accounts. Baby Boomer workers had the most retirement savings at $194,000, compared with Generation X ($93,000), Millennials ($50,000), and Generation Z ($40,000).

Researchers found that, “alarmingly,” 32 percent of Generation X and 26 percent of Boomers had less than $50,000 in retirement savings as they approached the age of retirement.

Read the full article here