House Republicans have proposed a $1,000 federally funded savings account for children under 8 to boost long-term financial security, calling it a “MAGA account.”

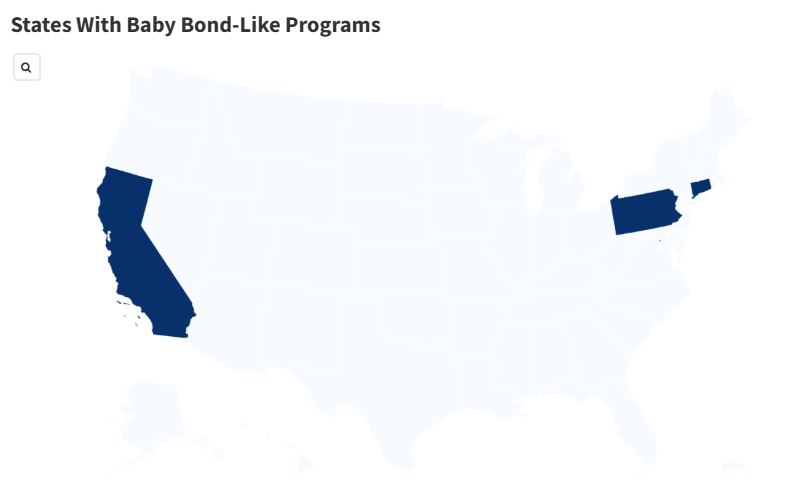

The acronym stands for “Money Account for Growth and Advancement.” A number of states have already adopted similar baby bonds programs to help parents get a head start in saving.

Why It Matters

By offering a certain amount of money to stay in savings or earn investment revenue over 18 years, children will have some money to apply to earning an education or other avenues in their young life once they become adults.

Proponents say this could reduce the reliance on the student loans in higher education and help Americans learn more about savings earlier on. Most states do not offer these type of baby bonds, but those that do mirror the MAGA account proposal.

What To Know

Several states and Washington, D.C., have created programs that effectively work as baby bonds. The child receives the money in a saving or investment account and they can then use the funding when they turn 18.

California

The California HOPE (Hope, Opportunity, Perseverance, and Empowerment) for Children Trust Account Program was created through Assembly Bill 156 in 2022 to confront intergenerational poverty and close the racial wealth gap.

Administered by the California State Treasurer’s Office, the program establishes trust accounts for eligible children—specifically those who have lost a parent or guardian to COVID-19 or who have spent over 18 months in foster care.

These accounts are projected to grow to $4,500 by age 18 and may be used to support the child’s path to financial independence, such as education or starting a business.

Connecticut

Connecticut’s Baby Bonds program, launched in 2023, invests $3,200 for every child born under HUSKY (Medicaid) coverage, with the funds growing until the child reaches adulthood.

Children must have been born on or after July 1, 2023, to qualify.

From age 18 to 30, recipients can use the funds—estimated to grow to between $11,000 and $24,000—for activities such as education, homeownership, or business investment.

The program aims to narrow racial and wealth inequality gaps, with state officials estimating that it could benefit around 15,000 to 16,000 children annually.

Washington, D.C.

The baby bond program in Washington, D.C., enacted in 2021, creates government-seeded trust accounts for children from low-income families born after October 1, 2021.

Eligible children from low-income households will receive a one-time deposit of $500, with up to $1,000 in annual contributions until the child turns 18, into an account managed by the city, for wealth-building uses like education, homeownership, or starting a business.

The program is part of broader efforts to reduce the racial wealth gap and support financial independence for historically marginalized communities

Pennsylvania

Pennsylvania’s Keystone Scholars initiative grants $100 to every baby born in the state on or after January 1, 2019.

The money is deposited into a PA 529 education savings account and is intended to grow over time and can be used for qualified higher education expenses. These accounts can be claimed approximately 4-6 months after the child is born.

What is the MAGA Savings Account Proposal?

The proposal from Congressional Republicans would provide a $1,000 federally funded deposit into a savings account for every child born to U.S. citizen parents under the age of 8, with the funds growing until the child reaches adulthood.

Families could contribute up to $5,000 annually without income restrictions, and contributions would be tax-deductible, according to reporting from Newsmax.

Withdrawals would be permitted at age 18 for specific uses like higher education, buying a home, or starting a business, according to the report.

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, noted that if the initial $1,000 deposit had a 5 percent return, children could see roughly $2,400 at age 18, while a more aggressive 10 percent investment return would lead to $5,560.

What People Are Saying

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek: “Politicians see these trusts as a one-two punch: help close racial wealth gaps while boosting school, home, and startup capital for low‑income kids. Over decades, compounding returns on can turn modest seeds into real opportunity. Potentially cutting the $240,100 median wealth gap between white and Black families in half.”

Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek: “They’re trying to close the wealth gap. These programs are aimed at giving kids, especially those from lower-income families or the foster care system, a financial head start. It’s about leveling the playing field a bit.”

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “The wealth divide in the United States has only grown larger over the last decade, with the pandemic and its inflationary aftermath making the financial gap one that many states are starting to view as unsustainable.”

“Regardless of purpose, the idea of forming a financial foundation for youth and getting them to understand the impact of saving and investing could be a major step forward if it forms better habits in these individuals over time.”

What Happens Next

Children who benefit from these programs could have a stronger financial support system when they turn 18 and look to either attend college or start a business, experts say.

“If you give kids a financial foundation, it changes the game. It means they have a little cushion when they hit 18, maybe for college, a down payment, or starting a business,” Thompson said. “These funds are usually parked in trust accounts that grow over time, building real value before they can access it.”

Read the full article here