A top economist has sounded the alarm about which states are likely to face a high risk of recession in the months to come.

Mark Zandi, chief economist at Moody’s Analytics, wrote on X that state-level data reveal the U.S. economy “is on the edge of recession.” Based on Zandi’s analysis, states that make up nearly a third of U.S. GDP (gross domestic product) are either in or at high risk of recession.

Why It Matters

The Trump administration has touted GDP growth rates, foreign investment and inflation metrics as proof of economic success and tariffs doing their job.

But some economists have warned that the United States is at the precipice of another recession, with Americans likely to experience the financial fallout.

What To Know

Zandi said while a third of the United States’ GDP comes from states either in or at high risk of recession, another third were “just holding steady,” and the remaining third are growing.

The states experiencing recessions were spread across the country, but Zandi wrote on X that “the broader DC area stands out due to government job cuts.”

“Southern states are generally the strongest, but their growth is slowing,” Zandi said. “California and New York, which together account for over a fifth of U.S. GDP, are holding their own, and their stability is crucial for the national economy to avoid a downturn.”

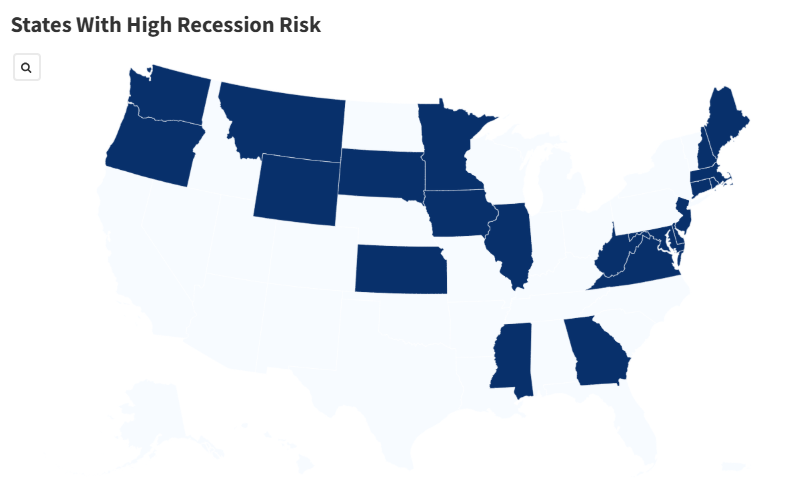

The full list of states, plus Washington, D.C., either in or at risk of recession, based on Zandi’s analysis, included:

- Wyoming

- Montana

- Minnesota

- Mississippi

- Kansas

- Massachusetts

- Washington

- Georgia

- New Hampshire

- Maryland

- Rhode Island

- Illinois

- Delaware

- Virginia

- Oregon

- Connecticut

- South Dakota

- New Jersey

- Maine

- Iowa

- West Virginia

“Many of these states lean heavily on farming or on import and trade activity. Those are exactly the industries most exposed under current trade policies,” Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek.

“For the average American, that risk shows up in two ways. It means higher prices at the store, and it means job disruption across industries tied to food, goods, and transportation.”

Some states’ economies were growing, however, including those of South Carolina, Idaho, Texas, Oklahoma, North Carolina, Alabama, Kentucky, Florida, Nebraska, Indiana, Louisiana, North Dakota, Arizona, Pennsylvania, Utah and Wisconsin.

The remaining states were considered to be “treading water,” according to Zandi’s analysis.

Zandi, who was one of the first economists to forecast the 2008 financial crisis, told Newsweek that all the warning signs for an impending recession were already there.

“I don’t think the economy is in a recession, at least not at this point,” he said, “but it feels like it’s on the brink, it’s on the precipice of this recession.”

Job growth has stalled to what Zandi described as a “virtual standstill.”

“That’s the firewall between recession and no recession, is the low layoffs. So we’re not in recession, but I’d say the indicator that’s flashing reddest is jobs,” Zandi said.

“As soon as you see negative employment—payroll employment decline in a month—that’s when alarm bells should start going off,” he added. “And I would anticipate that that’s going to happen, and that’s going to happen soon.”

Zandi also said he anticipates the annual inflation rate, currently at 2.7 percent, to increase above 3 percent and approach 4 percent by this time next year.

“Prices are already rising, you can see it in the data, but it’s going to rise to a degree that it will be impossible for people to ignore,” Zandi said. “They’ll see it clearly in the things that they’re buying on an everyday basis.”

What People Are Saying

Moody’s Analytics chief economist Mark Zandi previously told Newsweek: “I think what happens with California and New York may decide what happens to the nation,” he said. “I mean, if California and New York weaken and start to contract, the national economy is going to go into recession.”

Kevin Thompson, CEO of 9i Capital Group, told Newsweek: “The broader takeaway is that a significant portion of the U.S. economy (29.4 percent) is being flagged as high risk for recession. Whether you accept the technical definition or a looser one, it’s hard to deny that the economy is slowing. Much of that slowdown feels self-imposed. The kind of structural change being pushed right now amounts to a full retooling of the American economy, and retooling never comes without pain. There has to be some bad before any good can come out of it.”

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “Even for states like New York and California that combine for 20 percent of the nation’s GDP, there are signs of concern. While neither are in the high-risk category, they’re economically treading water at this point. The general economic uncertainty of the moment is triggering slowing job growth and consumer spending. Until that uncertainty lifts, it’s probably these risk percentages will only go up.”

What Happens Next

The United States is currently facing an economic split, with an individual’s financial life heavily dependent on where they live, experts say.

“For the average person, this creates a weird economic split screen. If you’re in Texas or Florida, you’re still seeing job growth and wage increases. If you’re in Maryland or Virginia, you’re watching neighbors get laid off and home values shrink,” Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek.

Two of the most populous states, California and New York, may be the ones that decide whether the country enters a full-on recession, Ryan said.

“California and New York holding steady is what’s keeping us from a national recession,” Ryan said. “When those two economic powerhouses, representing over 20 percent of GDP, are just treading water instead of growing. Well that’s actually the warning sign. They’re not pulling the national economy forward anymore; they’re just not dragging it down yet.”

Read the full article here