Key Takeaways

- Stocks rallied, but tariff threats and bond yields cloud outlook

- Nvidia earnings, Fed minutes could shift market tone significantly

- Equities upbeat, yet VIX suggests volatility may still linger

Stocks staged a broad rally on Tuesday following a long holiday weekend. The S&P 500 gained 2%. Both the Nasdaq Composite and Russell 2000 were higher by 2.5%, while the Dow Jones Industrial Average notched a gain of 1.8%. The rally came after a whirlwind of trade and tariff activity.

Last Friday, President Donald Trump announced he would place a 50% tariff on imported goods from the European Union. Following weekend discussions with EU leaders, those plans were put on hold until July 9. That date is significant because it will also mark the end of the three-month pause that was placed on retaliatory tariffs for a number of countries, including China. While we’ve heard that deals are being made, we haven’t actually seen any trade deals actually signed. With just six weeks to go before a potentially massive disruption to the economy, stocks seem somewhat optimistic that deals will be reached ahead of that deadline.

However, I want to point out the divergence between equities and bonds. While stocks are roughly 3.5% off all-time highs, bonds remain stuck in the mud with interest rates holding steady at higher levels for the last few months. The yield on 30-year bonds is currently just under 5%. The benchmark 10-year bond is yielding 4.47%. Although rates are off their highs, they are still elevated and worth watching. Going back to the housing crisis, stocks and bonds and have been tightly correlated. Therefore, the uncoupling we’re seeing is worth noting.

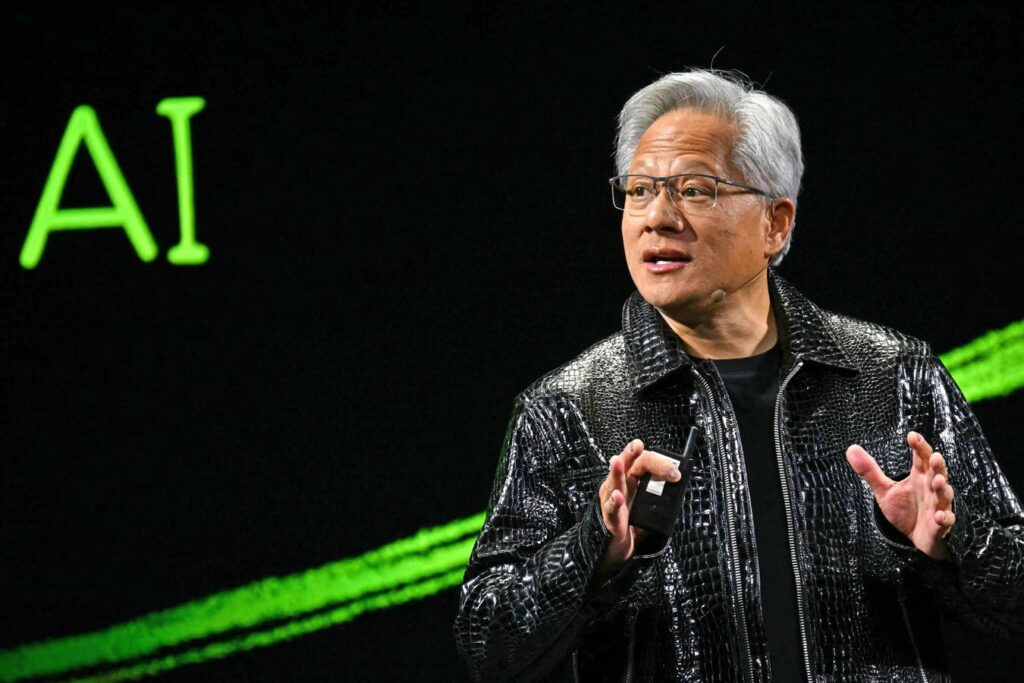

While the vast majority of earnings are in the rearview mirror, we do have three names worth mentioning. Macy’s reported in premarket and delivered results that were ahead of earnings and sales estimates for the first quarter. However, in what has become a common theme, the company warned of tariff headwinds moving forward and cut its profit outlook. In addition to Macy’s, both Salesforce and Nvidia will report earnings later on Wednesday. Ahead of its release Wednesday afternoon, Salesforce announced an $8 billion acquisition to buy Informatica on Tuesday, which is a data management software company. The acquisition is being described as a strategic move deeper into artificial intelligence. The options market is pricing the expected move for the week in Salesforce at right around 7%. We’ll also hear from arguably the most anticipated company, Nvidia, after Wednesday’s close.

It’s been a volatile year for Nvidia. After hitting a high of $153 in January, the stock fell by nearly 50% to a low of $86 in April. Since then, shares have rallied back to $135. The AI trade, which dominated market activity much of the last few years, has been a bit lost in the trade war shuffle. However, with things currently at a lull, I expect a lot of attention on this earnings announcement. The options market is pricing in a 6% expected move for the rest of this week.

In addition to earnings announcements after the close, we’ll also get minutes from the most recent Federal Reserve Open Market Committee meeting. I think most investors want to know how the Fed is thinking about interest rate policy vis-à-vis current tariffs and the potential impact of higher tariffs to come. Thus far, Federal Reserve Chair Jerome Powell has been hesitant to cut rates with the economic outlook uncertain, and I expect the minutes will reflect a continuation of that approach.

For Wednesday, I suspect markets will largely be waiting on Nvidia. This is still a company that can move not just the chip sector, but the entire market. I’m also continuing to watch volatility. Despite a simmering in the trade war, VIX is hovering around 19 and still above its historical average of 16. While equity price action has been encouraging, until we get a confirmation with VIX back at 16, I believe there is still room for choppy trading. As always, I would stick with your investing plans and long-term objectives.

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here