Boeing (NYSE: BA) recently reported its Q3 results, with the top-line meeting but the bottom line missing the street estimates. The company reported revenue of $17.8 billion and an adjusted loss of $10.44 per share, compared to the consensus estimates of $17.8 billion and $10.34 loss per share. There are near-term headwinds for the company stemming from the ongoing 737 MAX production issues and the ongoing workers strike. In this note, we discuss key takeaways from its recent results, valuation, and Boeing stock performance.

How Did Boeing Fare In Q3?

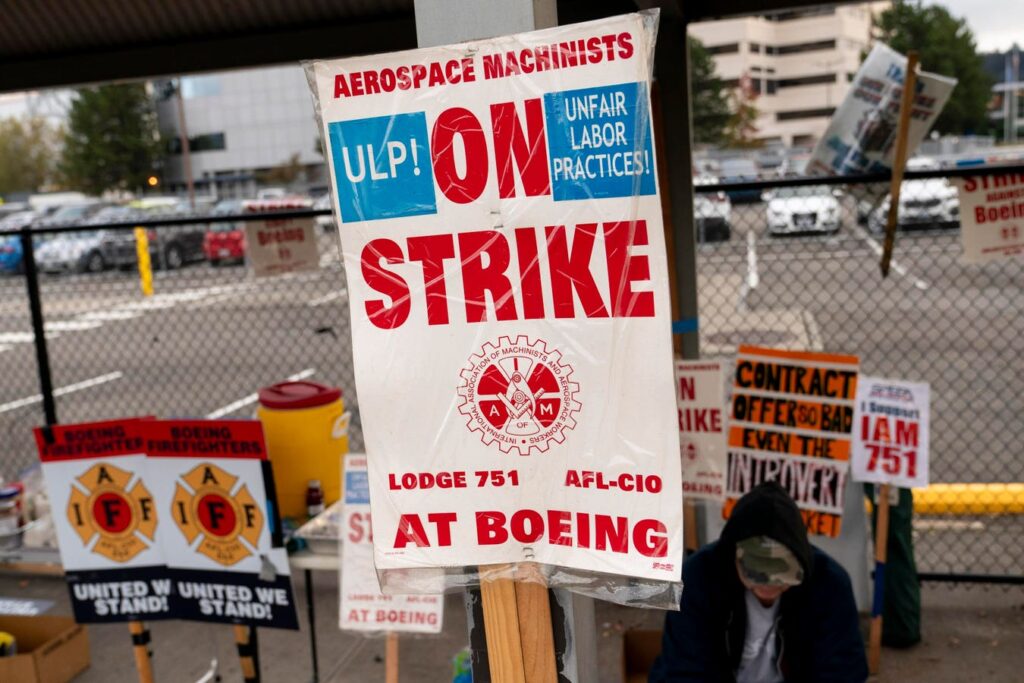

Boeing’s revenue of $17.8 billion in Q3 reflected a 1% y-o-y growth. The company delivered 116 airplanes in Q3, reflecting a 10% y-o-y growth. Still, the commercial airplanes segment revenue declined 5% y-o-y. Defense, space and security revenue were up 1% and global services sales were up 2% during the quarter. The company’s costs continue to rise, and its operating margin plunged to -33.6% during the quarter. This compares with the -6.0% figure in the prior-year-period. This can primarily be attributed to the impact of the International Association of Machinists and Aerospace Workers strike.

Looking forward, the losses may continue to pile up till the time Boeing reaches an agreement with its workers. The production ramp up may take more than earlier anticipated. We expect the company to generate sales of around $70 billion this year, reflecting a 10% y-o-y decline.

What Does This Mean For Boeing Stock?

BA stock has had a tough year so far, with one issue after the other plaguing its stock performance. Check out – Has The 737 MAX Clipped Boeing’s Wings? – for more details on the company’s issues in the first half of the year. BA stock is now down 42% this year, significantly underperforming the broader markets, with the S&P 500 index up 23%. Even if we look at a slightly longer period, the decrease in BA stock over the last three-year period has been far from consistent and has largely been as volatile as the S&P 500. In contrast, the Trefis High Quality Portfolio, with a collection of 30 stocks, is less volatile. And it has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

We now estimate Boeing’s Valuation to be $178 per share, reflecting an upside of more than 10% from its current levels of $157. Our forecast is based on 1.5x revenues for BA, slightly lower than the stock’s average P/S ratio of 1.8x over the last three years. A slight decline in the valuation multiple from its historical average for Boeing seems justified, given the ongoing issues and its impact on near-term profitability. We think Boeing’s losses will expand to $16 per share this year. But, with a ramp up in production next year, it should return to profitability.

While Boeing stock looks like it has some room for growth, it is helpful to see how Boeing’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here