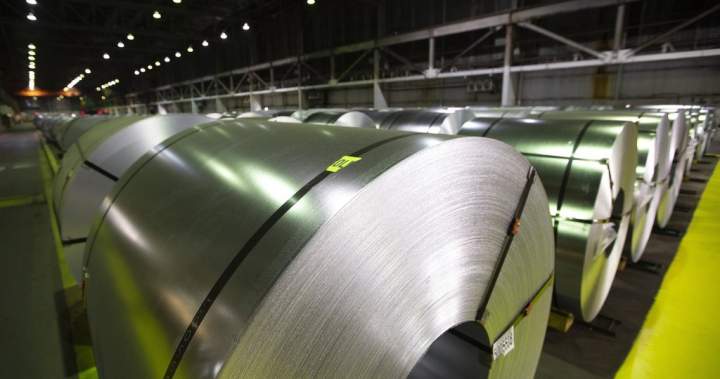

Some top American steel producers are cheering on U.S. President Donald Trump’s tariffs on foreign steel while raising prices on their own products, with one steelmaker urging Canada to copy Trump’s protectionist trade policies.

Both Cleveland-Cliffs and Steel Dynamics said in their latest quarterly earnings reports this week that they are charging buyers about 14 per cent more than they did in the previous quarter, while Acerinox said it is considering doing the same as soon as this fall.

Economists say such price increases are a natural result of tariffs, and are warning Canada to avoid the Trump administration’s “sledgehammer” approach that ends up squeezing buyers.

“A scalpel approach is much more necessary here, because it’s so complex,” said Harish Krishnan, a professor at the University of British Columbia’s Sauder School of Business who focuses on supply chain management.

The U.S. approach, he added, “is going to be negative for costs in the short and long term.”

Steel Dynamics reported on Tuesday its average steel price in the second quarter of this year was US$1,134 per tonne, up from US$998 in the first quarter. Cleveland-Cliffs said it was selling steel during the same quarter at US$1,015 a tonne on average, up from US$980 in the first quarter.

Acerinox, the largest producer of stainless steel in the U.S., said in a post-earnings call Thursday it was also looking to increase its prices later this year, but CEO Bernardo Velazquez acknowledged doing so “is not easy under the current circumstances.”

The CEO of Daimler Truck North America, which buys steel for the school buses and semi-trucks it manufactures, told the New York Times this week that it would be difficult to pass on the higher steel costs to its customers, particularly at a time of lower demand for its products.

The company said last week it was reducing its workforce by 2,000 employees.

“Whenever you introduce a tariff, it has two effects,” said Werner Antweiller, an economics professor and chair in international trade policy at the University of British Columbia.

“It basically raises the prices in the market overall because it curtails output, and so consumers are paying a higher price overall, and then the domestic producers are pulling even to the price of the foreign producers.”

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

Antweiller said those higher costs will have downstream impacts not just on buyers like Daimler Truck, but also the North American auto industry, which relies on steel and aluminum — including American automakers that Trump has said he wants to protect.

Despite those impacts, Krishnan said, “As profit maximizers, it makes total sense for the sellers to raise their prices.”

Both Cleveland-Cliffs and Steel Dynamics said they expect prices to remain stable in upcoming quarters — meaning they will remain at higher levels.

In a post-earnings call Tuesday, Cleveland-Cliffs CEO Lourenco Goncalves described the “strong improvements in pricing” and said Trump’s steel tariffs, which went up to 50 per cent in June, “have played a significant role in supporting the domestic steel industry.”

The company told investors that imported steel has dropped from 25 per cent of the U.S. market share in January to 20 per cent in April and May, after Trump first re-imposed the tariffs at a 25 per cent rate.

Executives at Steel Dynamics were more muted. While CEO Mark Millett said higher prices had boosted profitability for the company, “the uncertainty regarding trade policy continues to cause hesitancy in customer order patterns across our businesses.”

The uncertainty has roiled Canada’s own steel industry, which, like the U.S., has historically contended with imports and has called on the federal government to stop foreign dumping of steel due to Trump’s tariffs.

Prime Minister Mark Carney last week said Ottawa will change its steel tariff-rate quotas from 100 per cent to just 50 per cent of 2024 volumes for non-free trade agreement countries. Any imports that fall above that rate will face a 50 per cent tariff, which will also be applied to imports from free trade agreement partners above 100 per cent of 2024 volumes.

Additional duties will also be imposed on 25 per cent of steel imports from all non-U.S. countries that contain steel melted and poured in China before the end of July, Carney added.

Goncalves on Tuesday claimed the new measures will only affect 17 per cent of the steel imported to Canada, and urged Carney to expand its tariffs to all foreign trade partners in line with the U.S. He said countries with free trade agreements “continue to use Canada as their outlet for overproduction.”

Cleveland-Cliffs owns the Canadian steel company Stelco after buying it from U.S. Steel last year.

“If Prime Minister Carney and his cabinet really want to have a steel industry in Canada, they should put in place significant trade protections,” Goncalves said during Tuesday’s call. “Then they will have a strong domestic steel industry in Canada, able to support a vibrant and domestic Canadian market.

“We are doing just that here in the United States, and it’s working.”

Antweiller warned Ottawa against following that advice.

“It would actually raise prices here in Canada too, and that would again hurt the industry downstream,” he said. “And that is even more important because there are so many more jobs in the auto industry than there are in the steel industry.”

The Canadian Steel Producers Association, whose membership includes Stelco, declined to comment on Goncalves’ comments when asked by Global News.

The industry group last week applauded the federal government’s updated measures to protect Canada’s steel sector, after criticizing the initial plan announced last month that included lower tariff rate quotas.

Yet companies are seeing damage to their own bottom lines. Algoma Steel confirmed Thursday it was in talks with the federal government about potential liquidity relief measures, including an application to the federal Large Enterprise Tariff Loan program for $500 million.

Industry Minister Melanie Joly told reporters early this month the government was talking to Rio Tinto about potential liquidity relief as well.

Both Goncalves and Millett, the Steel Dynamics CEO, said Tuesday they expect the steel and aluminum tariffs to stay in place even under negotiated trade deals that see other country or sector-specific tariffs removed.

“So far, there is no indication that the Section 232 tariffs will be used as a bargaining chip by the Trump administration as leverage in trade deals with other countries,” Goncalves said.

Federal negotiators have said the steel and aluminum tariffs have been a focus of talks with the U.S. toward a new trade and security deal.

Trump has threatened Canada with new tariffs starting Aug. 1 unless a deal is set.

Economists are hopeful that the White House begins to see the damage that will be created if the tariffs remain in place.

“Our integrated market is worth so much to both sides, and moving away from this is going to hurt the Americans as much as us,” Antweiller said.

“I think that realization ought to take hold in the United States.”

Read the full article here