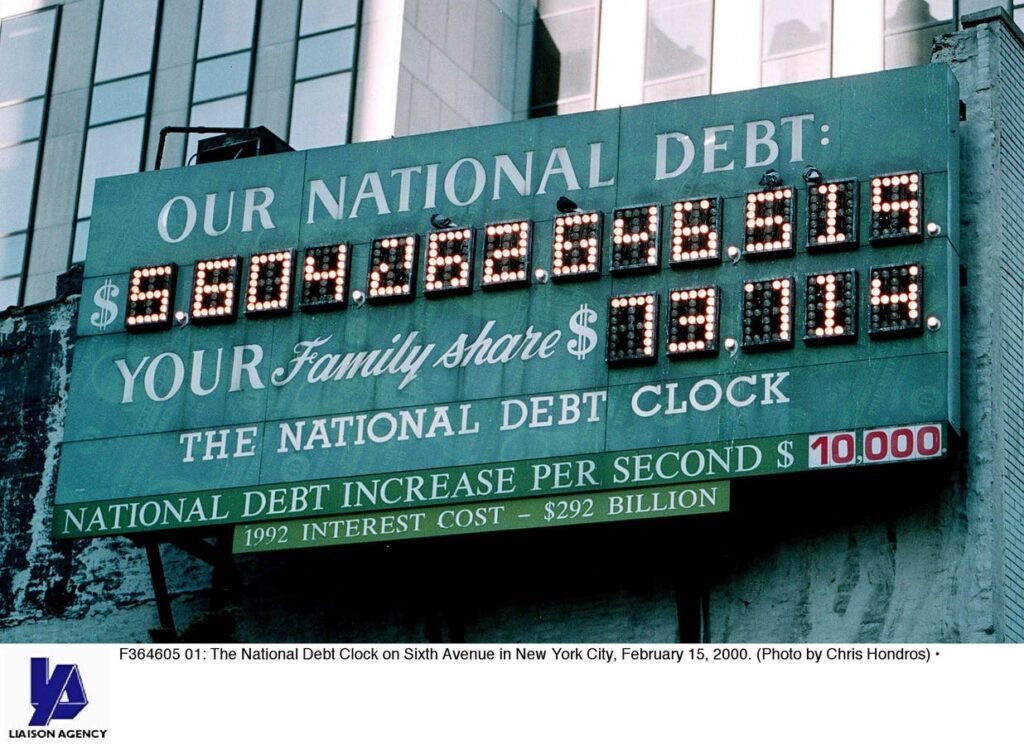

The Congressional Budget Office (CBO) just recently announced the latest on the fiscal 2024 budget deficit. It is a whopping $1.8 trillion, a big figure even for Washington. Outstanding amounts of federal debt already exceed the economy’s annual output of goods and services. Meanwhile, both presidential candidates are out promising actions that, if enacted would only swell this tide of red ink. Worse, few if any in Washington seem bothered by the situation and those few who talk about deficits insist on distractions and studiously avoid the fraught politics implicit in where the budget’s underlying problem lies: the uncontrollable growth of entitlements spending. This pattern of either ignoring red ink or dwelling on distractions points to future economic and financial difficulties.

Late in the last century, when it was still politically fashionable to worry over public debt levels and budget deficits, the great distraction involved a focus on what were called “tipping points.” These allowed politicians and not a few economists to sound concerned and issue grave warnings. But no one offered solutions. The fact is that no such “tipping point” exists. Japan, for instance, carries a government debt burden some 260% of that country’s gross domestic product (GDP) and far higher than the United States. Yet Japan’s economy, though it is hardly a juggernaut of economic growth, runs smoothly enough and produces high levels of prosperity. In contrast, the United States in the 1970s suffered terrible inflationary pressures, financial dislocation, and substandard economic performance even though its outstanding government debt averaged only 33% of the county’s GDP.

Today’s the distractions from underlying budget issues revolve not surprisingly around the presidential campaign and are typified by the University of Pennsylvania’s Penn-Wharton economic model. It has issued warnings that the Harris-Walz program will cumulate over the next ten years to an amount $1.2 trillion higher than current law would. Trump’s policies, the model calculates, will cumulate to $5.8 trillion more over this period. These projections captured some media attention and even made an albeit brief appearance in the second presidential debate. No one, however, put them in their needed perspective, allowing the figures to serve as a distraction rather than a basis for analysis or a consideration of remedies.

The fact is that current law will in 2025 erase the 2017 tax reform and accordingly impose a 20% tax hike on individuals and corporations. Since Trump has promised to make the 2017 reforms permanent, the Penn-Wharton model treats his policies as a 20% tax cut. It is a cut from what current law would do but it is not a cut from the code as it presently stands. This one consideration accounts for more than 80% of the calculated cumulative deficit the model assigns to Trump policies. To point this out would require people to come down one side or the other about this prospect of a tax hike. Surely it is easier (and safer) to just talk gravely about the figures.

None of this is to defend Trump. Even abstracting from this important matter, his promises would add to the river of red ink. But this perspective should reveal how shallow current conversation on budget issues remain. Meanwhile, Washington shows no of sign of venturing into the turbulent political waters of the underlying budget and debt problem: the fantastic, ongoing, and uncontrolled growth of entitlements spending—on Social Security, Medicare, disability payments, subsidies under the affordable care act, and assorted other programs.

Here the statistics are remarkably straightforward. Entitlements have grown from 45.3% of the budget (and 9.5% of the nation’s GDP) in 1990 to over 60% of the budget in 2024 (and some 15.4% of GDP.) This growth has occurred automatically without a congressional vote. The budget office captures the automatic nature of this spending by referring to entitlements as “mandatory programs.” During these last 30 years of so, relative declines in defense spending have blunted the overall budgetary effect of relentless entitlements increases. Defense spending has dropped from 23.9% of the budget (and 5.0% of GDP) in 1990 to 12.9% of the budget (and 3.2% of GDP) in the most recent fiscal year. The cushion afforded by relative defense cuts has enabled the political establishment simply to ignore the fundamental budget problem.

But in today’s dangerous world, future such defense cuts are unlikely. More, the retirement of the huge baby boom generation will only add to entitlements spending pressures, in Social Security and Medicare especially. And the accumulation of debt will also relentlessly enlarge the need for more monies to pay the interest due on it. Quite aside from the usual election year giveaways by either party, the deficits and debt will grow and do so relentlessly, and so accordingly will the debt load.

This relentless and excessive growth in debt will, even if there is no dramatic “tipping point,” nonetheless have ill effects on American finance and the economy. Fiscal flexibility will suffer, whether the need stems from domestic or foreign matters. Washington’s ever-larger call on the nation’s financial resources will absorb funds that would be better used by businesses and individuals to improve the economy’s efficiency and productive capacities. The pace of growth will as a consequence suffer an ongoing drag, and an inflationary bias will chronically trouble the economic environment.

Nor does it seem likely that the political class will take remedial steps, certainly not any time soon. Indeed, the presidential election campaign shows that either party is more likely to enlarge rather than control future dollar flows into entitlements programs. If, as is likely, the economy becomes more constrained, politicians will face more demands for entitlements spending and, if history is any guide, they will yield to those demands. It is a grim prospect indeed.

Read the full article here