Only a few months ago venture capitalists were still calling 2024 a deep-freeze for fintech. Aggregate investment across the sector had fallen more than 70 percent from its pandemic peak, and CB Insights put total global fintech funding in the first quarter of 2025 at just US $10.3 billion—a far cry from the US $38 billion quarters of 2021. Yet in the 10 days between 13 and 23 May the tone flipped. Four mature private companies: Acrisure, Airwallex, Addepar and Bestow, each captured fresh cheques of nine figures or more, together drawing roughly US $2.75 billion. Taken as a set, the deals suggest that the exit window investors dismissed as “shut” may be inching open just in time for an autumn listing season.

The deals that changed the weather

The largest splash came first. On 20 May Michigan-based insurtech-cum-financial-services platform Acrisure secured US $2.1 billion in convertible preferred stock led by Bain Capital and Apollo Funds. This round pushed its valuation to US $32 billion, about 40 percent higher than its last mark in 2021. Management says part of the money refinances expensive legacy instruments; the rest funds M&A that will nudge Acrisure beyond brokerage into payroll, cybersecurity, and employee benefits. More revealing was the way CFO Lowell Singer described the raise: “This gives us balance-sheet clarity ahead of any public-market option.” In banker-speak, that is the equivalent of pointing at the S-1 stack on the corner of the desk.

Hours later, Airwallex—founded in Melbourne, headquartered in Singapore—announced a US $300 million Series F at a US $6.2 billion valuation. Half the round was secondary, handing early employees and angels long-sought liquidity, but the primary tranche brings the company’s total funding to more than US $1.2 billion. Airwallex now processes payments in 60 countries, tracking toward US $1 billion in annualised revenue for 2025. Co-founder Jack Zhang called the up-round an “important milestone on our path to the public markets,” adding that he wants at least two EBITDA-positive quarters before filing.

A day later wealth-tech platform Addepar revealed a US $230 million Series G that values it at US $3.25 billion. More than half the proceeds go to a tender offer for long-time shareholders, house-cleaning that venture lawyers typically advise before a company flips its registration. Addepar now claims US $7 trillion of client assets on its analytics stack and insists it will be profitable in 2025.

Finally, Dallas-based insurtech Bestow closed an oversubscribed US $120 million Series D co-led by Goldman Sachs Alternatives and Smith Point Capital, plus a US $50 million credit facility from TriplePoint. Bestow divested its consumer life-insurance carrier last year and now licenses underwriting software to incumbents, a pivot that tripled annual recurring revenue in 2024 and, according to CEO Melbourne O’Banion, turned the firm “cash-flow neutral on a run-rate basis.”

Four data points do not make a trend, but they do cluster around a narrative: late-stage investors have decided that fintech companies with real revenue, global footprints and near-term profitability can once again command large cheques at flat-to-up valuations.

Why the ice is cracking

Several forces are converging. First, capital concentration. Limited partners are pressuring growth funds to deploy cash that has been sitting, fee-dragging, in drawdown notices. Instead of sprinkling Series B bets, those funds are writing fewer, larger tickets into businesses that can plausibly go public inside two years. Acrisure’s raise alone absorbs pockets of dry powder that might otherwise have been scattered across a dozen smaller rounds.

Second, profit visibility has become the gating item for every term sheet. All four firms either print black ink already or forecast it within 12 months. Airwallex’s FX spread actually widens when the US dollar surges, providing a natural hedge against higher rates. Acrisure throws off cash from a traditional brokerage arm. Addepar skates on software-as-a-service margins. Investors no longer have to squint to see operating leverage.

Third, secondary liquidity is back in fashion. Airwallex and Addepar earmarked roughly half of their rounds for early employee or seed-fund liquidity, a move that only makes sense if buyers believe they can recycle shares through an IPO at a premium within 18 to 24 months. Venture secondary specialists confirm that secondary prints have tightened from 60 percent discounts to low double-digits on marquee names.

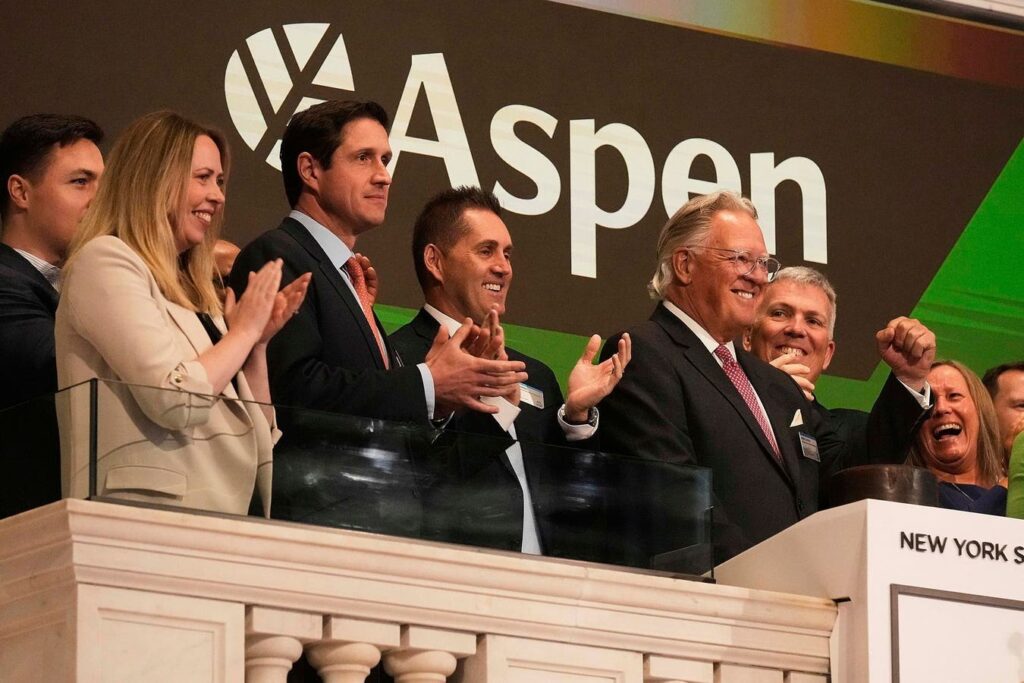

Finally, public-market tone has brightened, if only at the margins. On 8 May, Apollo-owned Aspen Insurance raised US $397 million in the largest US insurance IPO since 2022; shares popped 11 percent on day one. Investors looking for recession-resilient cash flow found it in sectoral plays like specialty insurance, and that is exactly the pitch Acrisure will make when it comes knocking.

Reading the Q3 runway

Bankers who worked on the recent rounds say file-ready documentation is already circulating. Acrisure has sounded out bulge-bracket banks for a dual-track that could see a confidential filing as early as July. Airwallex insiders point to October as the first window, contingent on two consecutive profitable quarters and the completion of licensing in Japan and the UAE. Addepar’s tender offer paperwork explicitly notes that “liquidity alternatives, including a potential initial public offering, may be pursued within a reasonable horizon.”

If even two of the quartet launch roadshows, they will join a backlog of mature fintechs—Stripe, Rapyd, Nium, Klarna, Monzo, waiting for underwriting desks to reopen. Momentum breeds momentum: each successful float provides price discovery that the next issuer can cite, widening the aperture a little more.

Where valuations now sit

Private investors are once again paying forward for growth, though they remain more conservative than in 2021. At ≈5.5 × projected 2025 revenue, Airwallex’s post-money multiple is richer than Wise, which trades around 3 × on the London Stock Exchange, but lower than the frothy nine-times prints of 2021. Acrisure’s ≈12 × EBITDA multiple sits between listed brokerage Brown & Brown and pure-play insurtech Lemonade, which still languishes below book. Addepar’s ≈11 × ARR is healthy but not outrageous next to Bloomberg’s implied 15 × private-market valuation.

What could still derail the thaw

Plenty. A move by the Federal Reserve or the Trump Administration that sends the ten-year Treasury back above five percent would sap risk appetite faster than any venture round can close. Regulatory curve-balls also loom. Acrisure’s diversification into cyber and payments invites capital-adequacy scrutiny; Airwallex still has to complete multi-jurisdiction licensing across four continents before public investors will underwrite geopolitical risk. And an overcrowded IPO calendar can force valuation haircuts if buy-side funds lack bandwidth to diligence every deal.

The bottom line

Clustered activity does not guarantee a full-blown spring. It does, however, mark the first time since late 2021 that growth-stage fintechs have raised multi-hundred-million-dollar rounds at higher valuations and funnelled meaningful cash to secondary sellers. That only happens when investors see a clear exit path.

For founders, the signal is clear: if you can show real revenue growth, a short march to profitability and a plausible public-market comp, capital is once again on the table. For public-equity investors, a gentle warning: the pipeline is lining up. The window many declared shut is at least ajar, and if markets hold steady through the summer, Q3 could bring the busiest fintech IPO season in three years, one megadeal at a time.

If Aspen’s modest float was the starter pistol, the funding flurry of late May may prove to be the warm-up lap. Whether the race truly begins this autumn will depend on macro stability, but for the first time in a long while, fintech’s next class of public companies is stepping up to the blocks.

Read the full article here