Reported theft of Supplemental Nutrition Assistance Program (SNAP) benefits surged at the start of 2025, according to new U.S. Department of Agriculture (USDA) data.

From the final quarter of 2024 to the first quarter of 2025, total reported SNAP benefit thefts climbed from 444,553 to 691,604, a 55 percent jump in a single quarter. Between the second quarter of 2023 and 2025, nearly 2 million SNAP thefts have been reported to the USDA.

Why It Matters

SNAP benefit theft targets the most vulnerable low- and no-income Americans who rely on benefits to feed their families. SNAP is delivered through electronic benefit transfer (EBT) cards, which are loaded with funds each month and used in participating stores nationwide. Because the cards function much like debit cards at the point of sale, they can also be targeted by familiar fraud tactics, including cloning, phishing and skimming.

What To Know

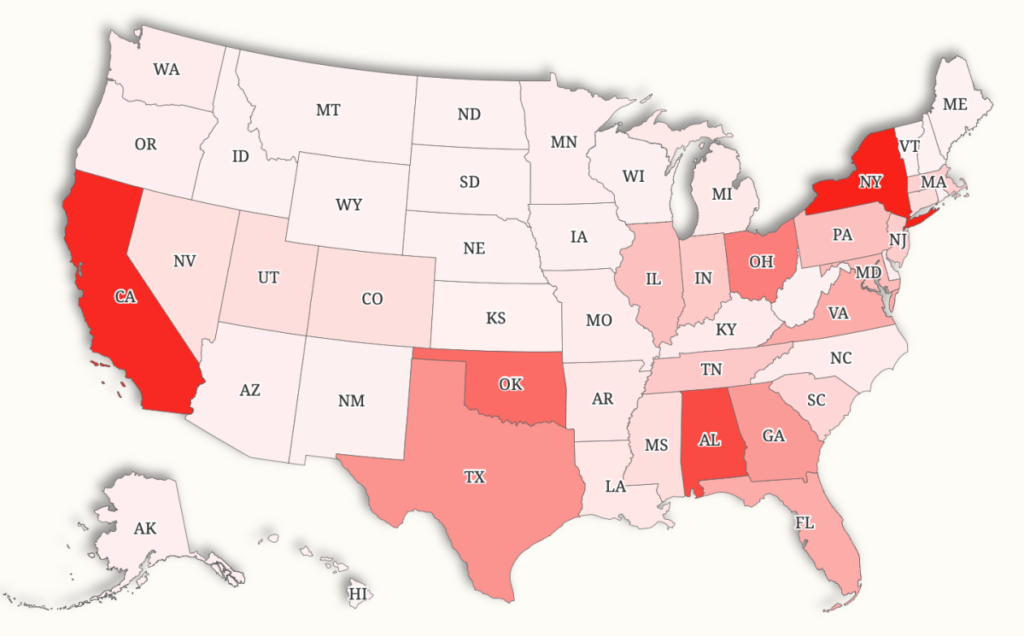

In the first quarter of 2025, the largest reported totals were concentrated in a handful of states. New York recorded 33,468 reported thefts, just ahead of California at 32,258. The next highest totals were in Alabama (26,919), Oklahoma (21,553) and Ohio (18,476).

In Alabama, the number of recorded SNAP thefts increased by a staggering 327 percent, up from 6,304. An even sharper rise was reported in Oklahoma, where reported thefts jumped by 564 percent.

The picture looked different only months earlier. In the final quarter of 2024, New York and California also led the country, with 27,593 and 25,732 reported thefts respectively. But the rest of the top five then included Florida (13,751), Texas (10,014) and Tennessee (9,782).

New York and California also posted clear quarter-to-quarter increases, and topped the list in both quarters. New York rose from 27,593 reported thefts in Q4 2024 to 33,468 in Q1 2025 – an increase of 5,875. California climbed from 25,732 to 32,258, an increase of 6,526.

The surge in reports comes as concerns persist about the security features available on many SNAP benefit cards. Most EBT cards do not include theft-prevention tools such as microchips, which are standard on commercial debit cards. Microchips cannot eliminate fraud altogether, but they can deter some schemes and help reduce vulnerability to skimming devices. State SNAP agencies are not currently required to add microchips to EBT cards, though bills have been put forward in some states like New York that could change this.

A Persistent Problem

Because SNAP is administered federally but operated by state SNAP agencies, the response to theft has varied. Agencies have taken steps recommended by the USDA, including modernization efforts. California has updated its SNAP EBT cards to better align with credit and debit card security standards, and several other states have ongoing projects aimed at improving card security.

Some safeguards may also be available to recipients directly, depending on the state. In certain places, people can lock their EBT cards to help prevent unauthorized purchases, block specific transaction types or receive alerts when a purchase is made.

The USDA also urges recipients to take steps to reduce risk, including changing a card PIN frequently, not sharing card information and staying alert for impostors posing as government agencies. Anyone who believes their benefits have been stolen is advised to contact their local SNAP office.

Read the full article here